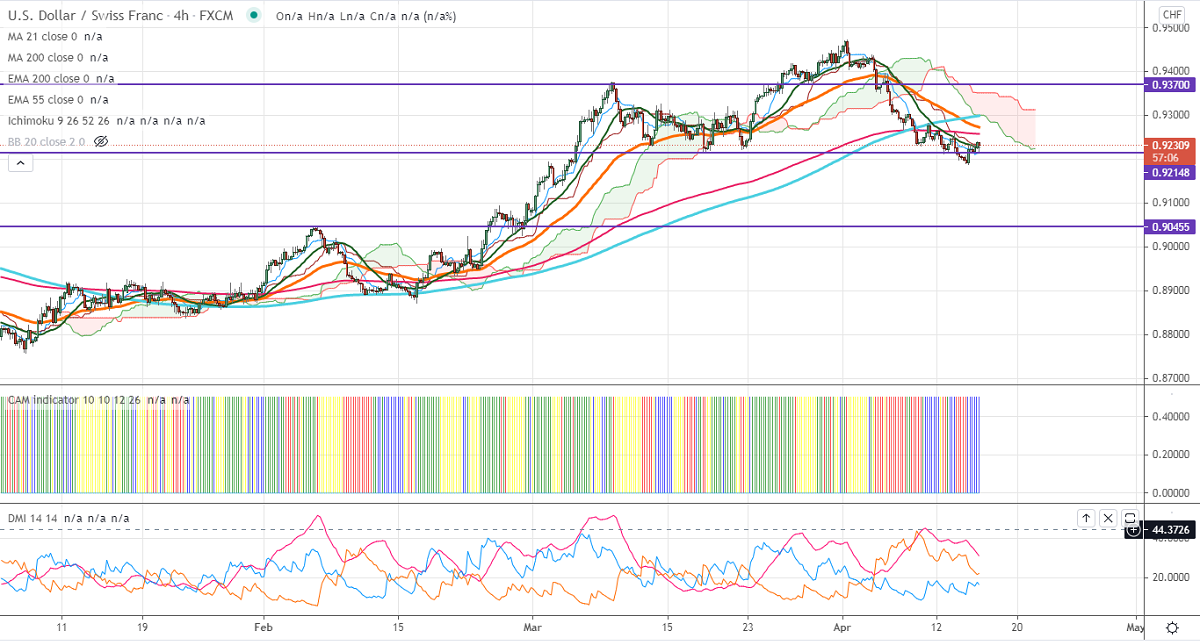

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.92135

Kijun-Sen- 0.92343

USDCHF is trading weak after hitting a high of 0.92400 on broad-based US dollar selling. . The US dollar index and USDCHF are positively correlated to each other. DXY is holding well below 92 levels, any violation below 91.50 will drag the index down to 91. The US 10-yield declined more than 5% despite better than expected US CPI data. Markets eye US retail sales, jobless claims, and Philly Fed manufacturing index. The overall trend is bearish as long as resistance 0.9370 holds. USDCHF hits an intraday low of 0.92189 and is currently trading around 0.92198.

The pair is facing significant resistance at 0.9240; any jump above this confirms intraday bullishness. A jump to 0.92850/0.9325/0.9370 likely. Significant bullish continuation only if it breaks 0.94725. On the lower side, significant support stands at 0.9180, any indicative break below targets 0.91497/0.9100.

Ichimoku Analysis- The pair is trading below 4-hour Kijun-Sen, Tenken-Sen, and cloud. Minor weakness only if it breaks 0.9180.

Indicator (4-hour chart)

CAM indicator – Slightly bullish

Directional movement index – Bearish

It is good to sell on rallies around 0.9268-70 with SL around 0.9300 for a TP of 0.9150.