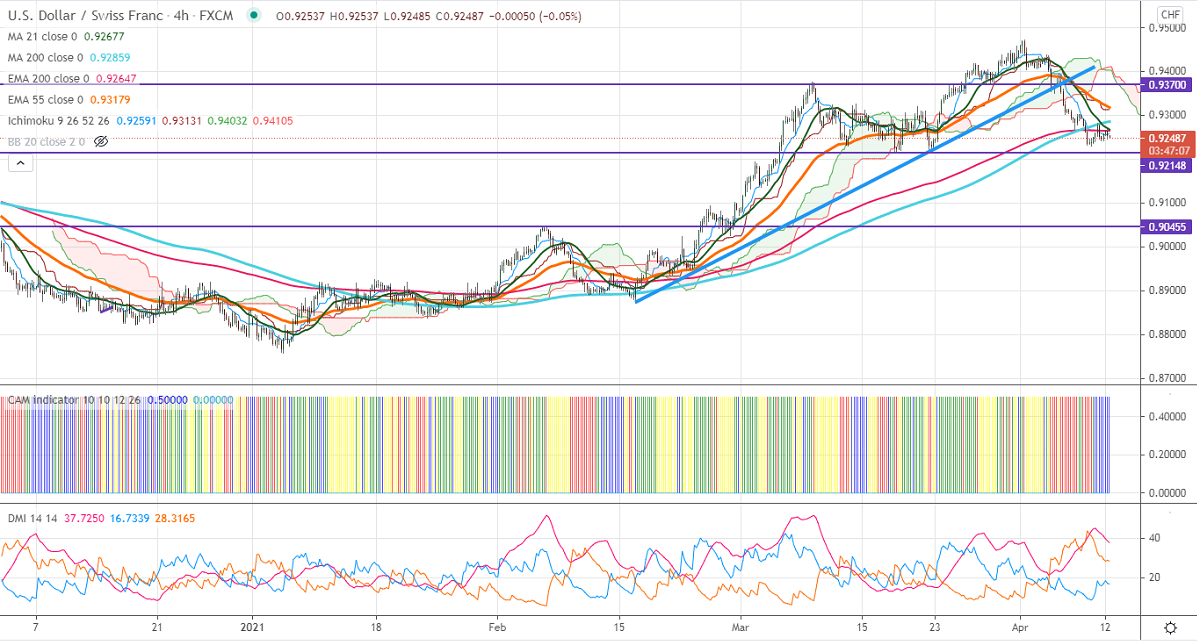

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.92559

Kijun-Sen- 0.93131

USDCHF is consolidating after hitting a low of 0.92300. Short term trend is bearish as long as resistance 0.9360 holds. The Fed Chairman said in CBS 60 minutes interview that the US economy is at an "inflection point". The slight upbeat market sentiment is putting pressure on the US dollar.DXY is holding above 92 level and significant intraday bullishness only if it breaks 92.50 level. USDCHF hits an intraday high of 0.92684 and is currently trading around 0.92508.

The pair is facing significant resistance at 0.92827 (200-4H MA); any jump above this confirms intraday bullishness. A jump till 0.9325/0.9370/0.9435 likely. The decline from 1.0223 got completed at 0.875 only if it breaks 0.9475. On the lower side, significant support stands at 0.9220, any indicative break below targets 0.91810/0.9147/0.9100.

Ichimoku Analysis- The pair is trading below 4-hour Kijun-Sen, Tenken-Sen, and cloud. Minor weakness only if it breaks 0.9260.

Indicator (4-hour chart)

CAM indicator – Slightly bullish

Directional movement index – bearish

It is good to sell on rallies around 0.93000 with SL around 0.9360 for a TP of 0.9150.