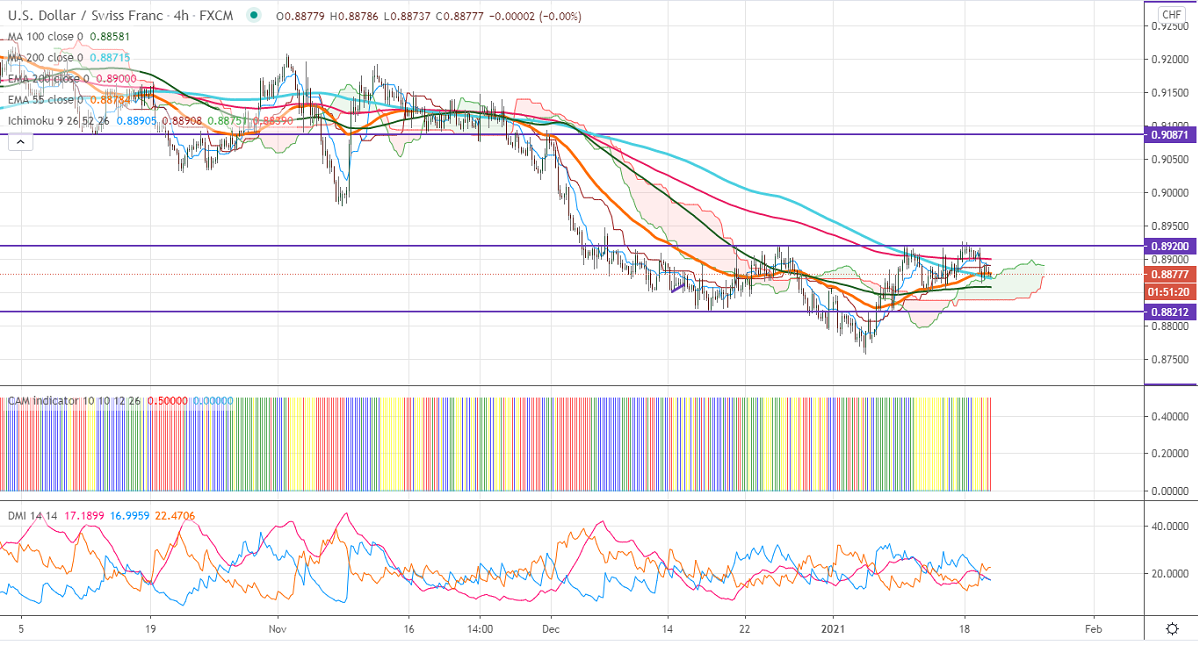

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.88907

Kijun-Sen- 0.88908

The intraday bias in USDCHF remains neutral as long as resistance 0.8920 holds. Any decisive break of 0.8919 confirms minor bottom formed at 0.8756. The chance of more stimulus and declining coronavirus cases is putting pressure on the US dollar index at higher levels. The US 10-year yield lost more than 3% after Janet Yellen's testimony. The US dollar index is holding well above 90 levels, any violation above 91.50 confirms bullish continuation.

The pair's near term resistance at 0.8920; any convincing violation above will take to the next level till 0.8948 (55- day EMA)/0.9000. On the lower side, significant support stands at 0.88583, any indicative break below targets 0.88250/0.8800/0.8750.

It is good to buy on dips around 0.8900 with SL around 0.8860 for a TP of 0.9000.