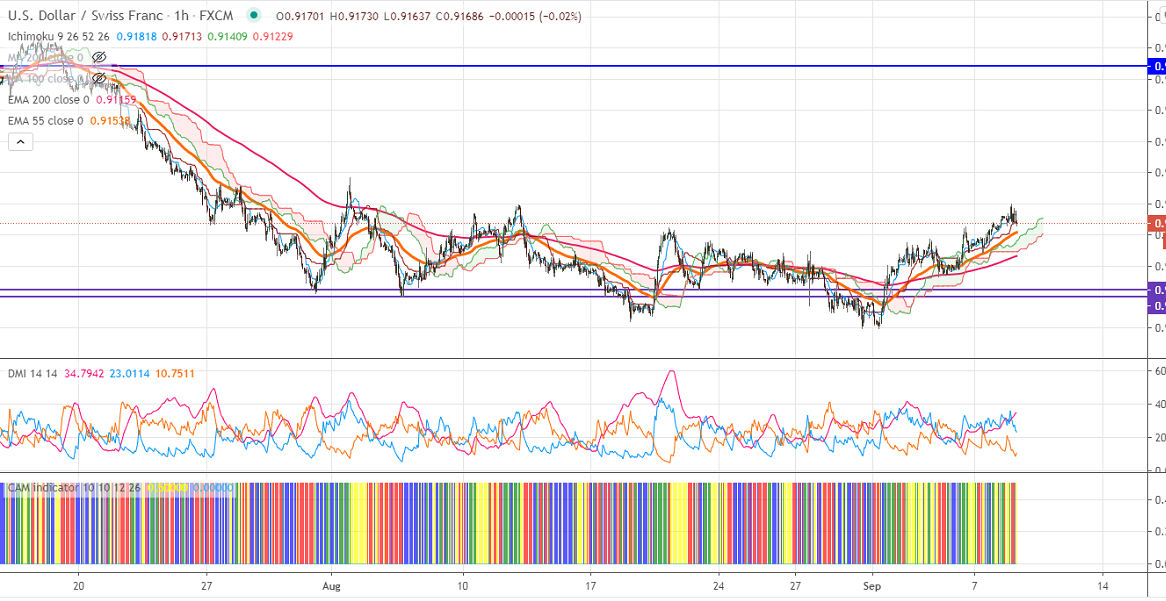

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 0.91823

Kijun-Sen- 0.91711

USDCHF continues to trade higher and holding well above 200-EMA. The broad-based US dollar buying and renewed US-Sino trade tension is supporting the US dollar. The United States 10-year bond yield declined more than 8% after forming a minor top around 0.723%. The pair hits an intraday high of 0.91999 and is currently trading around 0.91673.

The pair is still in a downtrend, any break above 0.9200 (Aug 12th high) confirms bullish continuation. Any violation above targets 0.9245. The near-term support is around 0.9150, any break below will drag the pair down till 0.91160/0.9080. The decline from 0.9900 will get completed at 0.9050 only if it breaks 0.9250.

It is good to buy on dips around 0.9128-30 with SL around 0.9080 for the TP of 0.9245.