The implied volatility of the South African rand is the highest among EMFX space, though not unjustifiably expensive versus realized volatility, which makes any vanilla USDZAR put option expensive.

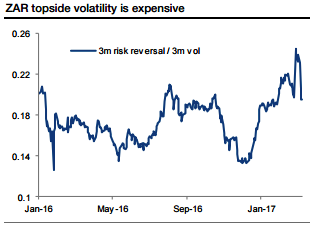

Skew is also elevated, with 3m 25d risk reversals being the highest across EM and in the upper half of the five-year historical range. The skew-to-ATM implied volatility ratio is at the top of the recent range, affording an opportunity to sell topside skew in a bullish ZAR structure.

Option mechanism:

Buy 3m USDZAR put strike 13.00 knock-out (KO) 14.20, indicative offer: 1.45% (vs 2.13% for the vanilla, spot ref: 13.0750).

The knock-out provides a 32% discount to the vanilla put option and also substitutes for a stop loss on outright short USDZAR exposure.

Risks profiling:

4% spike in next three months Investors buying a knock-out put cannot lose more than the premium paid.

However, the option will be worthless if USDZAR hits the 14.30 level at any time before the 3m expiry.

A strong payroll report could temporarily hurt the ZAR, and while a Fitch downgrade is partially priced in, it could cause another bout of temporary weakness.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data