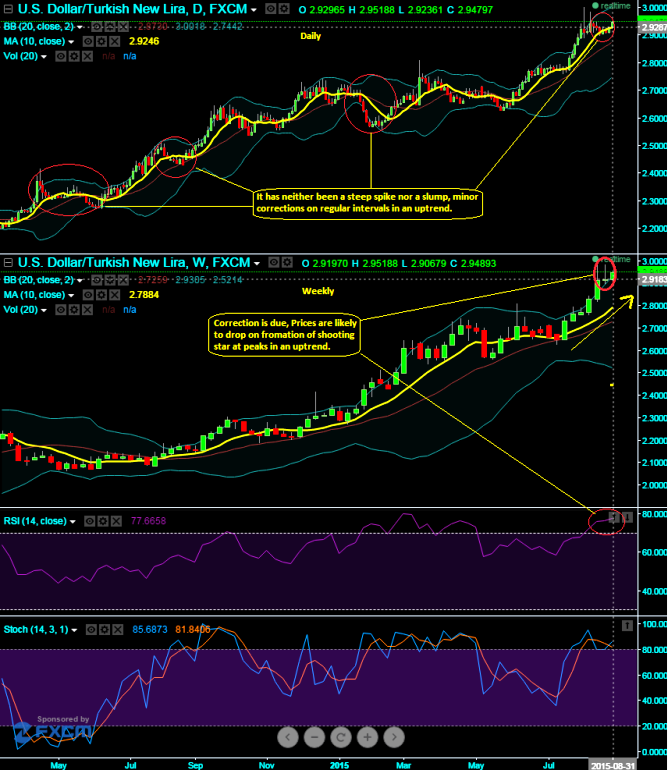

Technical briefing:

It's been a healthy uptrend for this pair as there is timely correction every as and when required, you can make out this from daily charts. So for now, weekly charts signal that a correction is needed at his point in time. A sharp shooting star is occurred at peaks around 2.9197 levels, while RSI oscillator has crossed 70 levels which is overbought territory, anytime a short time correction is most likely.

On fundamental front, the inflation in Turkey will likely increase due to depreciation pressures. We expect inflation in Turkey to rise in August towards 7% YoY as currency depreciation will likely feed into prices. The near-term inflation profile looked conducive in Q3; however, recent depreciation in TRY seems to work against this.

We noted earlier that risks to inflation outlook are still skewed to the upside: the volatile nature of food prices warrants caution, and the risk of further currency depreciation is non-negligible. External vulnerabilities leave Turkey exposed to the re-pricing of EM risk and the potential reversal of capital flows, which could be further exacerbated by rising domestic political uncertainty and higher geopolitical risks.

FxWirePro: USD/TRY shooting star signifies minor correction – inflation glitch due to currency depreciation

Wednesday, September 2, 2015 12:13 PM UTC

Editor's Picks

- Market Data

Most Popular