- The Turkish Lira rebounded from a 1-1/2 year low hit in the prior session on worsening fiscal balances.

- Turkey's fiscal data showed government budget deficit rose to TRY 43.7 billion in March, from TRY 7.36 billion in February.

- The International Institute of Finance expects Turkey’s economy will shrink by 2.7 percent this year, while Moody’s ratings agency predicts a cumulative gross domestic product contraction of 7 percent in the second and third quarters before a rebound.

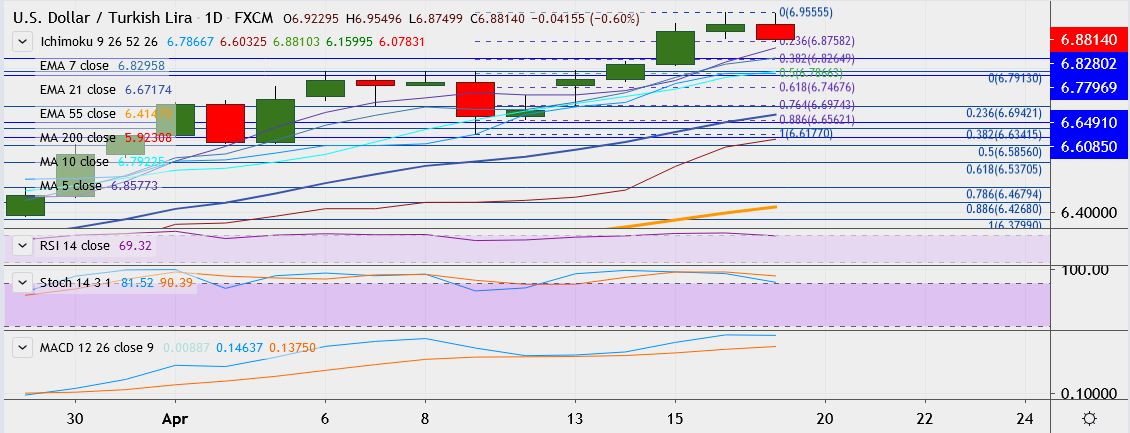

- USD/TRY is trading 0.3 percent lower at 6.9038, having hit a high of 6.9555 on Thursday, its highest since August 2018.

- Immediate resistance is located at 6.9571, any close above could take it above 6.9788.

- On the downside, support is seen at 6.8745 and break below could take it near 6.8264 (38.2% Fib).

Recommendation: Good to sell on rallies around 6.9147, with stop loss of 6.9245 and target price of 6.8595.