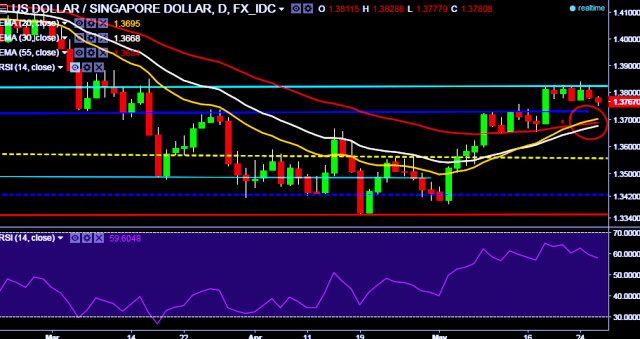

- USD/SGD is currently trading around 1.3772 marks.

- It made intraday high at 1.3788 and low at 1.3750 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.3823 levels.

- A daily close below 1.3772 will drag the parity down towards key supports 1.3628 (55D EMA) /1.3548/1.3420 (April 13, 2016 low) /1.3357 (April 20, 2016 low) /1.3318/1.3302 levels.

- Alternatively, a sustained close above 1.3823 tests key resistances at 1.3851(March 16, 2016 high), 1.4073 (20D EMA) and 1.4132(20D, 30D and 55D EMA crossover).

- Today, Singapore will release Manufacturing output data at 0500 GMT. Market anticipates a fall of 0.8% m/m vs 1.0% m/m previous release.

We prefer to take short position in USD/SGD around 1.3780, stop loss 1.3823 and target 1.3628 marks.