The strong Japanese IP report and business survey suggest solid momentum carried over into this year.

But, consumption appears to have been weak at the end of 2016, while the labor market looks favorable.

BoJ stayed on hold as widely expected; autopilot likely will continue at least until H2 of this year.

Abe would visit Trump next Friday, likely will try to persuade him that Japan is not a currency manipulator.

Aside from currencies buffeted by idiosyncratic factors (TRY, MXN, GBP), yen is the only other USD-major where owning vega has been profitable YTD. This owes primarily to USDJPY’s pronounced sensitivity to high frequency shifts in the US policy narrative since the November elections, both on the upside during phases of optimism around a muscular fiscal package and the attendant rise in Treasury yields, as well as on the downside when anxiety mounted around the Trump administration’s trade, tax and FX policy.

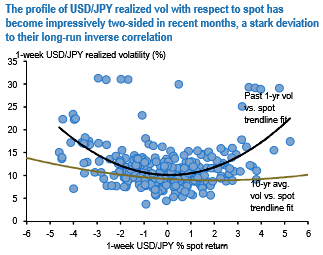

The latter does not surprise as yen appreciation and higher volatility during risk aversion is almost an axiom in currency markets; it is on the weaker yen side of the spot distribution that a new, higher volatility dynamic has emerged as US bond markets tantalizingly flirt with the prospect of breaking out of the post-GFC rate repression shackles.

There is also a flow angle to the story, in that perceptible leveraged macro-interest to position for USDJPY upside via options as a positive carry alternative to selling Treasuries has tended to generate a demand/ supply imbalance in the option market, which risks worsening if/when spot rallies towards 120 and prompts dealer demand for vega hedges against extant Japanese importer structures (e.g. knock-out forwards with barriers in the 125-130 zone).

The net result is a two-sided USDJPY realized volatility profile (refer above chart) that has proven relatively impervious to the direction of spot moves in recent months –unlike for most risk-sensitive currency pairs where spot vol correlation is well entrenched and has a distinct bias in favor of dollar strength – and is likely to persist as policy uncertainty in the US shows few signs of abating any time soon.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action