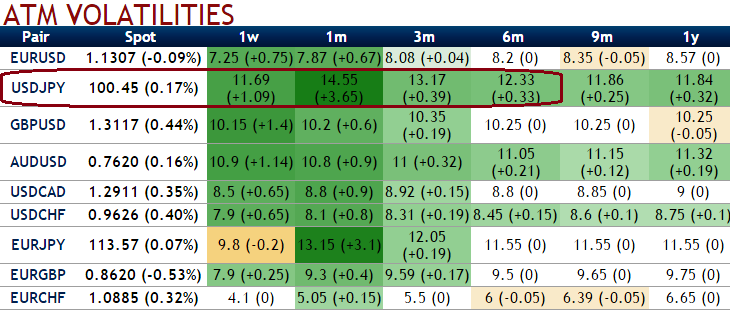

The latest FX options quant screener emphasizes that USDJPY remains the most expensive G10 volatility. It also has the most expensive smile parameters up to the 6m tenor.

It suggests buying an RKO put, taking advantage of the current market pricing. We pick the 6w tenor to get exposure to the near-term reaction to the next BoJ meeting.

Trade dynamics: Buy USD/JPY 6w put strike 97, knock-out 93 Indicative offer: 0.18% (vs 0.73% for the vanilla, spot ref: 100), we upheld the strategy in anticipation of something of a slide as we get below 100. Once we get to 95 or so, we’ll be getting ourselves emotionally attached to long-term yen shorts again, but that’s another story.

Risk profiling: Breaking the channel on the downside, the loss is limited to the premium, but the option will be cancelled if the spot hits 93 at any time. This level corresponds to the lower bound of the channel at end-September when the option expires, after the 21 September BoJ meeting.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close