We think current macro situations lead the fed rate hike to almost defer to 2016, but in this another 2 months leftover for December meeting until then if improved numbers come in then again rate speculation would still be lingering around dollar as the regional fed heads are making manipulative statements on this much awaited monetary policy outcome.

On the other hand, we can very much empathize with this Yen against dollar to gain slightly at least in short run (let's say next 2 months or so) with an anticipation of Fed may continue to hold on its rate stance until Q1'16 considering global economic slowdown and US job markets.

This would mean that market sentiments for this pair have been bearish for this pair. As a result, we reckon that for next 2 months time Yen may pretty much gain out of lots of manipulations and ambiguities are surrounding around dollar.

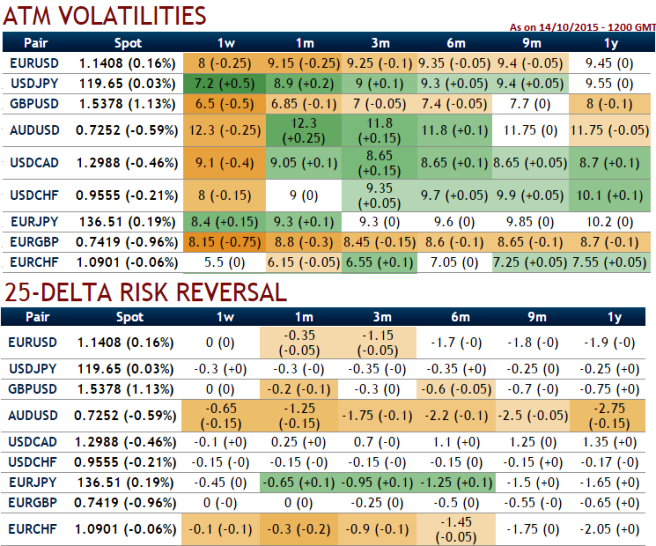

It is also understood that ATM contacts of USDJPY have gradually reduced implied volatilities after the much awaited fed's meet which did not evidence any change in its rate policy that could have propped up dollar's strength (see and compare current 1w & 1m contracts with the last week's contracts).

On the other hand, delta risk reversal for the pair is still highest negative values among entire G7 currency space for next 1-2 months, but we believe some short upswings may be utilized for shorts. (Compare delta risk reversal with last week).

The pair is likely to perceive implied volatility close to 8.9% of 1M ATM contracts that has increased from last week's 8.25%, thus we recommend deploying short put ladder spreads that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

So, short ITM put with shorter expiry since implied volatility is inching higher which is good for option writers and buy 2 lots of ATM and OTM put with longer expiry.

FxWirePro: USD/JPY sideways but slightly bearish – put ladder serves hedging motives

Thursday, October 15, 2015 6:45 AM UTC

Editor's Picks

- Market Data

Most Popular