USD/JPY chart on Trading View used for analysis

- USD/JPY ignores rising US Treasury yields, slips lower below 113 handle as yen remains bid.

- The yen garners more safe haven flows again amid growing angst surrounding the Chinese / US standoff. Italy also continues to weigh on investor sentiment.

- The major has edged higher from session lows at 112.93 and is currently holding above 113 handle.

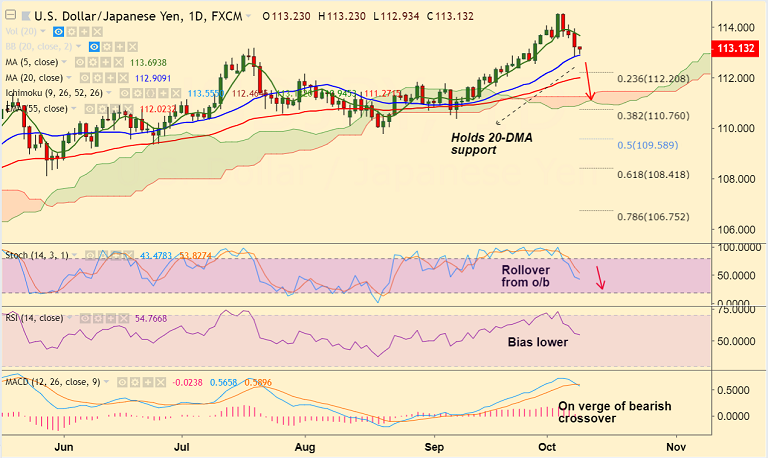

- However, technical indicators on daily charts have turned bearish. Stochs have rolled over from overbought levels.

- RSI is biased lower and MACD is on verge of a bearish crossover on signal line.

- Currently the pair holds strong support at 20-DMA at 112.90. Break below will see continuation of weakness.

- US CPI due later this week will be in focus for further impetus.

Support levels - 112.90 (20-DMA), 112.20 (23.6% Fib), 112.02 (55-EMA)

Resistance levels - 113.68 (5-DMA), 114

Recommendation: Stay short on decisive break below 20-DMA, SL: 113.70, TP: 112.20/ 112/ 111.30

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 25.3067 (Neutral), while Hourly JPY Spot Index was at 147.337 (Bullish) at 0400 GMT.

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.