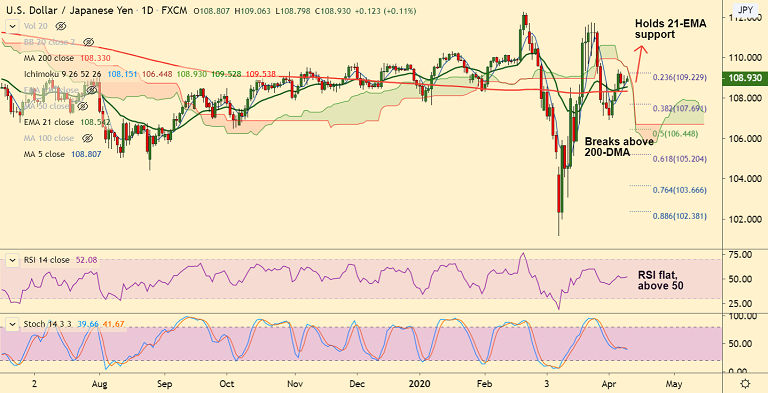

USD/JPY chart - Trading View

USD/JPY was trading marginally higher on the day at 108.94 at around 06:45 GMT.

The pair has held support at 21-EMA on Wednesday's trade, weakness only on break below.

FOMC minutes overnight highlighted concerns over the swiftness with which the coronavirus outbreak was harming the U.S. economy and disrupting financial markets.

The Fed reiterated that it would be appropriate to maintain rates at the current near-zero levels.

Fed Powell's speech and US jobs data will be watched for impetus ahead of the long weekend.

GMMA indicator shows major trend in the pair is neutral and minor trend is turning slightly bullish.

Daily cloud is stiff resistance. Break above could buoy prices. On the flipside, failure to hold above 200-DMA will negate any upside bias.

Major Support Levels - 108.54 (21-EMA), 108.33 (200-DMA), 107.69 (38.2% Fib)

Major Resistance Levels - 109.22 (23.6% Fib), 109.53 (Daily cloud), 109.66 (200W MA)

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise