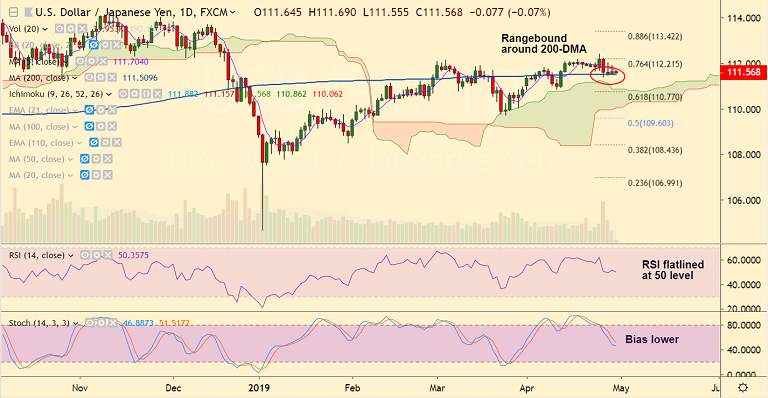

USD/JPY chart - Trading View

- USD/JPY is trading in a narrow range in the Asian session today, bias slightly bearish.

- The data released on Monday showed that the US consumer spending increased by the most in more than 9-1/2 years in March.

- Also, US yield curve is now steepest since the end of Nov, signaling fading recession fears.

- Focus remains on the Fed policy meeting on Wednesday May 1st for clear directional bias.

- The central bank is expected to remain on extended hold, while focus will be on the FOMC statement, followed by the Fed Chair Powell's press conference.

- Markets will keenly follow Powell's response to concerns about softer inflation readings and his take on the underlying strength of the economy, as well as the Fed's current view on financial stability.

- Technical indicators are inconclusive. The pair is hovering around 200-DMA and RSI is flat-lined around 50 levels.

- Below 200-DMA the pair finds serious of strong support till daily cloud at 110.86. Break below cloud top to see further weakness.

- Focus this week also on U.S. for ISM manufacturing and non-farm payrolls for further clues.

Support levels - 111.50 (200-DMA), 111.33 (50-DMA), 110.86 (cloud top)

Resistance levels - 111.70 (5-DMA), 112, 112.40 (Apr 24 high)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.