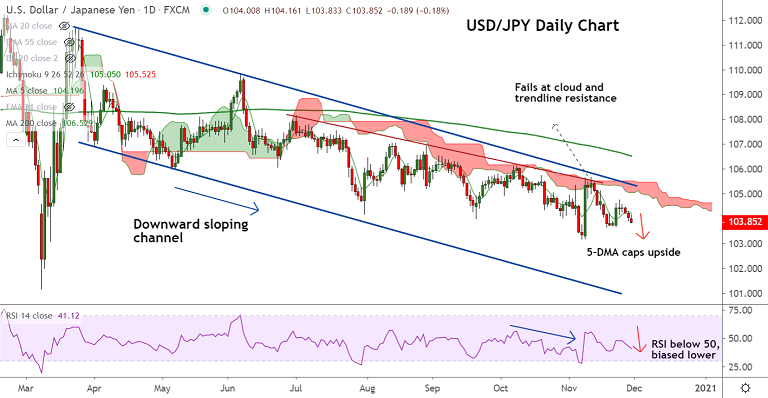

USD/JPY chart - Trading View

USD/JPY was trading 0.15% lower on the day at 103.89 at around 04:35 GMT, further weakness on charts.

The major grinds lower for the 3rd straight session after successive Dojis at 21-EMA resistance.

Upbeat Japan Industrial Production and Retail Sales data add to the bearish pressure on the pair.

Japan’s October month Retail Sales were up 6.4% YoY beating market consensus of -7.7%.

Further, preliminary readings of October’s Industrial Production recovered from -14.5% forecast and -9.0% prior to -3.2% YoY.

The U.S. dollar remains depressed across the board as fears of further worsening in the global coronavirus (COVID-19) numbers dampen market’s optimism.

Technical indicators are flashing bearish signals. Major and minor trend as evidenced by GMMA indicator are strongly bearish.

Upside remains capped at 5-DMA which is now biased lower and momentum studies support weakness.

Going forward, focus will be on the vaccine news and Brexit updates for further impetus. Scope for test of major trendline support at 101.65.