USD/JPY chart - Trading View

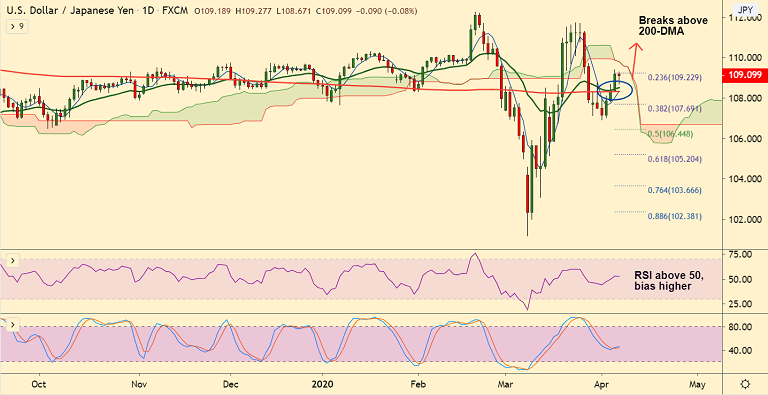

USD/JPY has bounced off session lows at 108.67 and was trading at 109.10 at 10:40 GMT.

The pair's near-term outlook has turned bullish after breakout at 200+DMA resistance on Monday's trade.

On the economic front, Japan's preliminary estimate of the February Leading Economic Index, came in at 92.1, beating the market’s forecast.

The Coincident Index for the February month was also better than anticipated, rising to 95.8.

Improving COVID-19 situation in some of the worst-hit countries dampens demand for the safe-haven yen.

Major trend in the pair is neutral, but minor trend is showing signs of bullishness as evidenced by the GMMA indicator.

Next major resistance aligns at 109.79 (daily cloud), break above to see retest of March highs at 111.71.

21-EMA is immediate support at 108.50. Retrace below 200-DMA negates any bullish bias.

Major Support Levels: 108.50 (21-EMA), 108.33 (converged 5 and 200 DMA), 107.69 (38.2% Fib)

Major Resistance Levels: 109.22 (23.6% Fib), 109.79 (Daily cloud), 110.29 (Jan 17 high)

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms