Bearish dollar scenarios:

1) Fed doesn’t tighten again in 2017 or allow the balance sheet run-off to begin.

2) Chinese growth turns higher in Q3 and Q4, compared to consensus expectations of stability or modest slowing.

3) Non-US central banks turn increasingly hawkish into year-end.

The Bank of Japan (BoJ) is scheduled to meet on July 19-20, announcing its decision on Thursday to review monetary policy and publish the quarterly economic outlook report. The Japanese central bank doesn’t seem to hint any change in policy stance

OTC indications and options strategy:

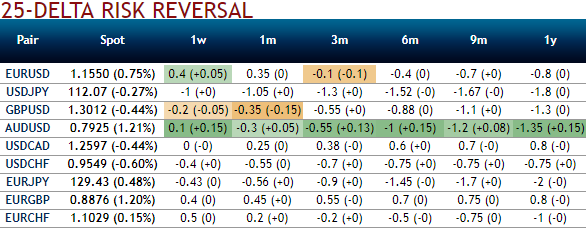

Please be noted that the nutshell above showing delta risk reversals for USDJPY has been flashing highest negative numbers among the G10 FX space. While IV skews of 1m tenors have also been indicating mounting bearish risks as the IVs have been positively skewed on OTM put strikes.

We reckon the below OTC indications and trend in USDJPY seems to be reasonably addressed by bearish hedging participants, hence, we advocate below option strategy to mitigate the uncertainty hovering for downside risks, the strategy likely to keep underlying price risk on check regardless of price swings with cost effectiveness.

Please be noted that the OTC markets for this underlying pair has been indicating the mounting bearish hedging sentiments in both short and long run (see risk reversals through 1w to 1y tenors).

For aggressive bears, buy a USDJPY debit put spread, 2m/1m 112.50 – 108.700.

For risk averse hedgers, buy USDJPY 1Y ATM straddle. Monetize erratic shifts in US policy focus at minimal carrying costs.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -114 levels (which is extremely bearish), while hourly JPY spot index was at shy above -43 (bearish) at the time of articulating (at 06:27 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch