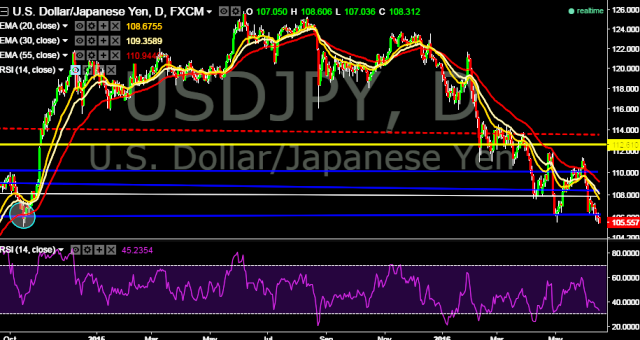

- USD/JPY is currently trading around 105.55 marks.

- It made intraday high at 106.02 and low at 105.53 levels.

- Intraday bias remains bearish for the moment.

- A daily close above 107.38 is required to take the parity higher towards key resistances around 107.90, 110.44, 112.60 (55D EMA) and 113.42 levels respectively.

- Alternatively, a sustained close below 106.00 will drag the parity down towards key supports at 105.19 (October 15, 2014 low) and 104.55 levels respectively.

Today BOJ will release monetary policy statement. This will provide further directions to the parity.