USD/JPY chart - Trading View

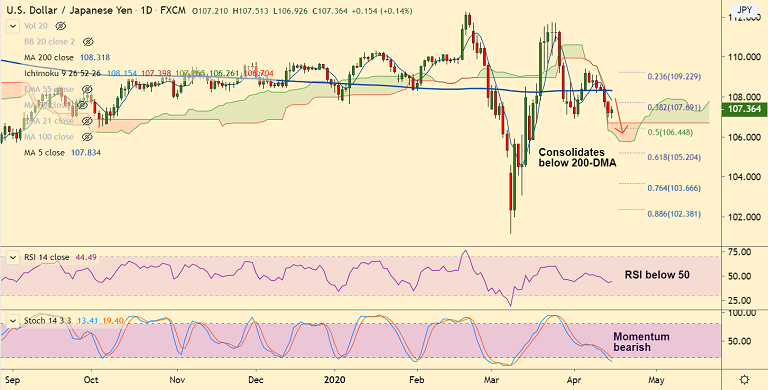

USD/JPY is extending marginal gains on the day, snapping a 4-day bear run, bias remains bearish.

USD recovering some lost ground following Tuesday’s sharp sell-off, holds above daily cloud support.

The major was trading 0.15% higher on the day at 107.37 at around 09:45 GMT after closing 0.51% lower in the previous session.

Retrace below 200-DMA has opened downside for the pair. Technical indicators also support weakness.

On the data front for the day remains on Retail Sales, Industrial Production, Capacity Utilization and the NAHB Index.

Major supports align at 106.70 (cloud top), 106.44 (50% Fib) and 105.20 (61.8% Fib). Retrace above 200-DMA negates any bearish bias.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One