USD/JPY chart - Trading View

Fundamental Overview:

USD/JPY is extending gains for the 3rd straight session, nears 3-week high above 109 handle.

The major was trading 0.86% higher on the day at 108.95, edging lower from session highs at 109.557.

Downbeat catalysts in the form of lower than expected Japan’s National Consumer Price Index and BOJ minutes favors further easing weigh on the yen.

Japan’s National Consumer Price Index (CPI) came in below 0.8% forecast On MoM to 0.4% whereas the CPI ex Food, Energy (YoY) slipped beneath 0.9% expectations to 0.6% for February.

BOJ minutes for the January month meeting offered additional support for the Japanese central bank’s Quantitative Easing (QE).

Technical Analysis:

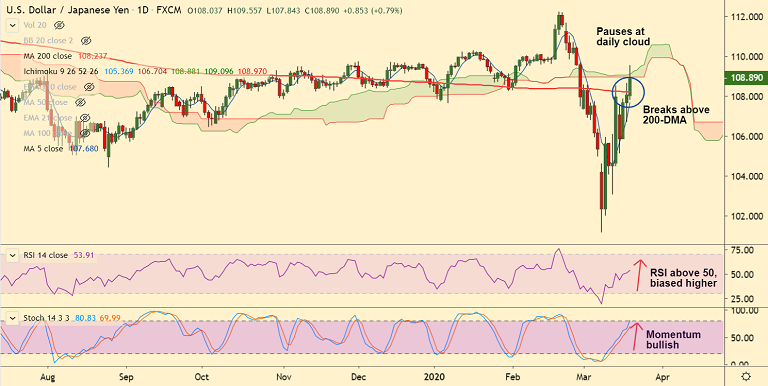

USD/JPY near-term bias has turned bullish after pair breaks above 200-DMA.

GMMA shows short-term moving averages have turned bullish.

Momentum studies are bullish. RSI has edged above 50 and is biased higher.

Stiff resistance is seen at daily cloud and 200W SMA at 109.09 and 109.65 respectively.

Breakout at 200W SMA will fuel more upside. Gains till 111 then likely.

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bullish Overbought

1D Bullish Neutral

1W Neutral Neutral

Support levels - 108.59 (110-EMA), 108.23 (200-DMA)

Resistance levels - 109.09 (cloud top), 109.65 (200W SMA)

Summary: Major stimulus from the global central banks/governments is supporting broad based dollar strength. Though fears of the deadly virus continue to weigh on the markets’ risk-tone, near-term gains in the pair look likely on sustained close above 200W SMA.

Intraday Trade Idea: Stay long on dips around 108.35/40, SL: 107.25, TP: 109/ 109.60

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025