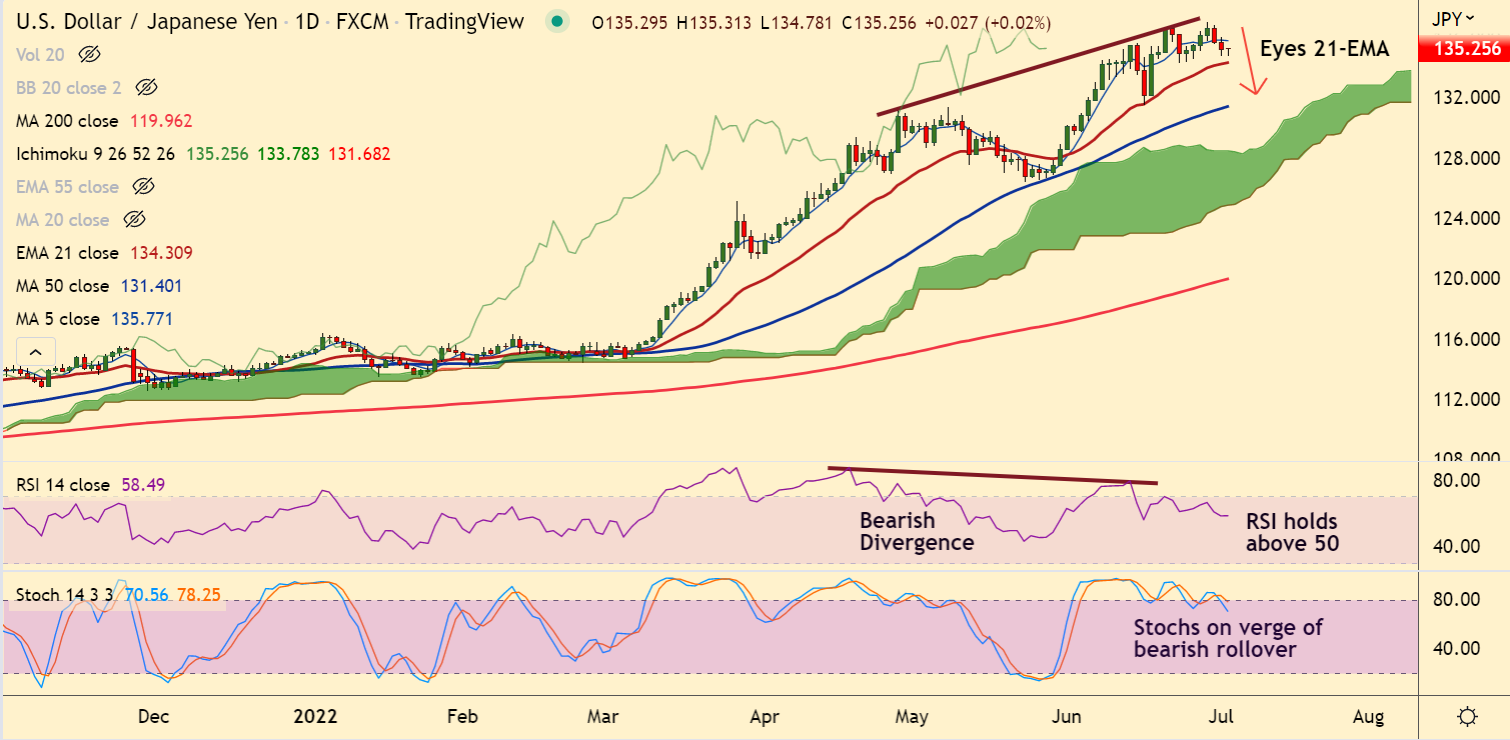

Chart - Courtesy Trading View

USD/JPY was trading 0.03% higher on the day at 135.26 at around 05:30 GMT.

The pair is hovering around 20-DMA support, consolidates break below 5-DMA.

BOJ’s ultra-loose monetary policy has weakened the yen bulls, keeping downside in the pair limited.

Poor performance of US ISM Manufacturing PMI kept the dollar depressed on Friday.

US ISM Manufacturing PMI printed at 53, lower than the expectations and the prior print of 54.9 and 56.1 respectively.

Market participants now await the release of the Federal Open Market Committee (FOMC) minutes for impetus.

USD/JPY has slipped below 200H MA. Bearish RSI divergence adds to the downside bias. MACD confirms bearish crossover on signal line.

Major Support Levels:

S1: 134.31 (21-EMA)

S2: 132.64 (Lower BB)

Major Resistance Levels:

R1: 135.77 (5-DMA)

R2: 137.20 (Upper BB)

Summary: USD/JPY bias remains bullish as long as pair holds above 21-EMA. Break below will change near-term dynamics.