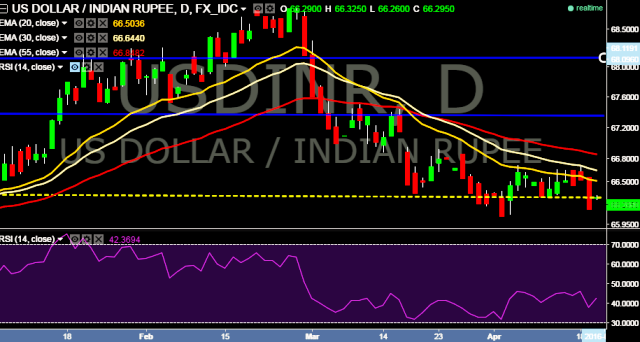

- USD/INR is currently trading at 66.3075 marks.

- It made intraday high at 66.3250 and low at 66.26 levels.

- Intraday bias remains neutral for the moment.

- A daily close below 66.32 will take the parity back around key support at 66.18/65.95 levels respectively.

- Alternatively, reversal from key support will turn bias slightly bullish and take the parity back above 67.00 marks.

- On the top side, key resistance levels are seen at 66.95, 67.15 and 67.7 levels.

We prefer to take long position in USD/INR only above 66.35, stop loss 66.14 and target 66.56/66.95 levels.