The HKMA upsized its intervention, and bought HKD17.6bn (USD2.2bn) over the past 24 hours, with total volume touching HKD51.3bn (USD6.5bn).

USDHKD, however, has been hovering around 7.8495, still quite close to its upper limit at 7.85.

This morning the HKMA said that it expects the HIBOR to rise incrementally, and they didn’t see large scale of shorting HKD positions.

On daily plotting of USDHKD, we spotted out whipsaws after major uptrend with a sharp hanging man pattern which is bearish in nature (see oval-shaped area). Well, this bearish pattern is coupled with RSI and stochastic curves boiling up with overbought pressures signals extreme weakness.

Whereas on the intermediate trend (refer weekly plotting), a potential hanging man is traced with one day to spare. Nevertheless, we cannot afford to isolate the signal as there is no substantiation from both leading as well as lagging indicators. Hence, contemplating the major uptrend, it is unwise to buck the trend.

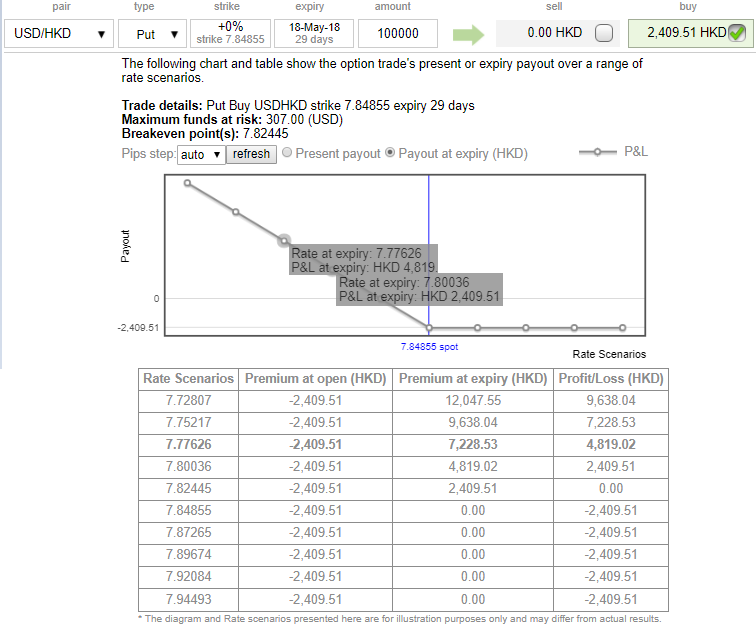

Consequently, with a view to arresting potential downside risks of USDHK, we advocate buying 1m -0.49 delta puts as shown in the diagram. Compared to short selling the underlying spot FX, it is more convenient to bet against the spot FX by purchasing put options as the investor does not have to borrow the underlying outrights.

Additionally, the risk is capped to the premium paid for the put options, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying spot FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Currency Strength Index: FxWirePro's hourly USD spot index was at 77 (bullish) while articulating at 14:09 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate