The Chinese economy grew 6.7% YoY in Q2 2016, unchanged from Q1, to bolster the growth in order to achieve 6.5-7.0% growth target, further monetary policy easing is still on the table. The slowdown in M2 growth in recent months hints that the PBoC has room to conduct monetary policy easing.

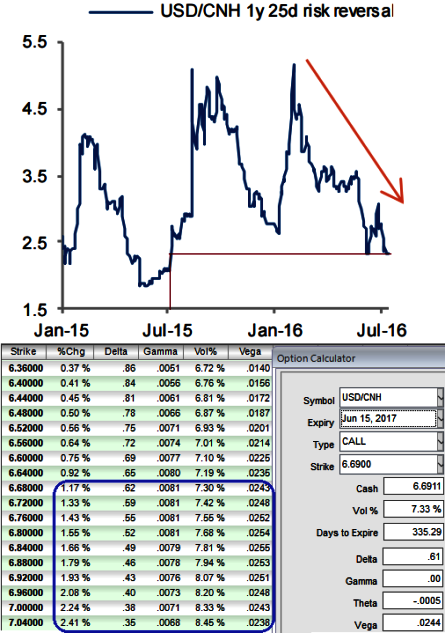

As stated in our recent write up on USDCNH IVs that shows the divergence with the realized volatility, shorting vega is advisable in such cases. Therefore, we call for below option strategy considering the on-going robust bullish environment last has lasted since 2014.

Buy USDCNH 1y Seagull strikes 6.55/6.85/7.20 Indicative offer: 0.42% (vs 0.82% for the call spread strikes 6.85/7.20, spot ref: 6.6910). This structure is a standard 1y call spread strikes 6.85/7.20 half financed by selling a put strike 6.55, offering beyond 7.20 a maximum leverage of 11x at the expiry.

With no digital risk involved and thanks to the limited convexity of long-dated options, the position can be conveniently delta-hedged if the spot moves lower in the early stages.

Risk reward profile: The 1y risk reversal is trading at a one-year low as shown in the diagram. It provides a good entry point to reload topside exposure despite the expensive volatility and also be noted that the healthy vega and gamma flashes on OTM call strikes. It also means that the vol market does not discount a disordered RMB depreciation, further supporting our short vega view.

Three-year-old depreciation trend reverses, the supply-demand imbalance in capital flows reaches equilibrium or hard-landing risks recede, causing the nearly three-year-old RMB depreciation cycle to reverse. The structure would face unlimited losses if USDCNH trades below the 6.55 strike in one year.

Vanilla calls or call spreads are too expensive when considering the probability-weighted terminal value of CNH a year from now. Under the premise that USDCNH only retraces a modest portion of the recent gains (similar to past experience when after an up move USDCNH did not revisit the lows and that there are no strong arguments for sustained appreciation on fundamental grounds, selling downside optionality can cheapen the cost of the call spread quite significantly.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025