On daily chart, this pair has been moving in a straight line direction, implied volatility of ATM contracts are also suggesting a very lackluster movement in the months to come. It has been gradually reducing to 10%, while delta risk reversal being neutral, this would mean that there is no much speculation in option markets but it does not mean that foreign trades having this currency exposure can be rest assured with open portions. Although, on long term basis it has been uptrend but we expect range bounded movements in short to medium terms.

Currency Hedging Framework: USDCHF

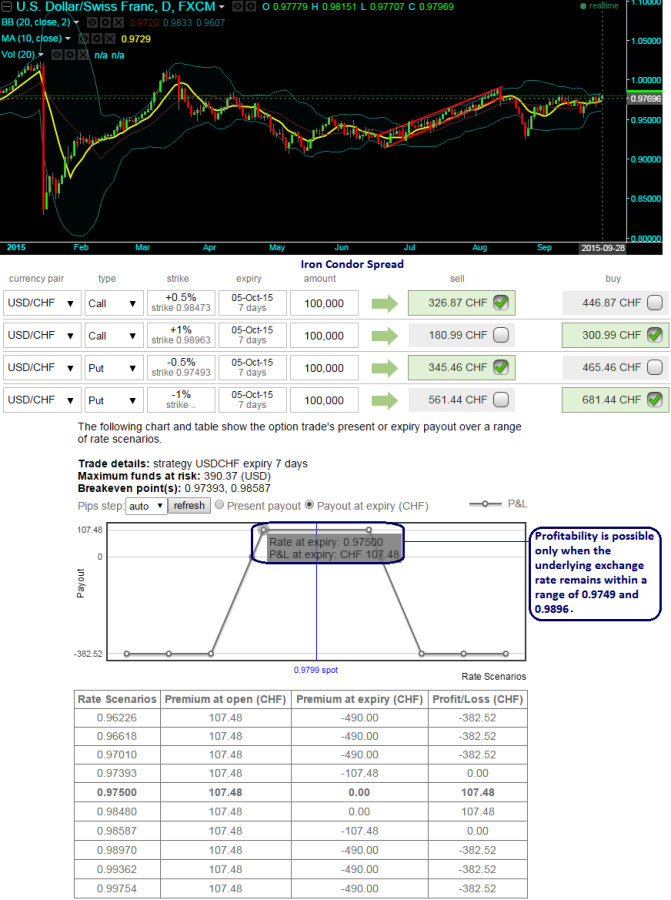

We advise shorting OTM put and buy deep OTM put, simultaneously short OTM call and deep OTM call options with identical maturities. Maximum loss for the iron condor spread is also limited but significantly higher than the maximum profit. It occurs when the exchange rate of USDCHF falls at or below the lower strike of the put purchased or rise above or equal to the higher strike of the call purchased. In either situation, maximum loss is equal to the difference in strike between the calls (or puts) minus the net credit received when entering the trade.

How do Greeks monitor the trend: Theta is your friend. You earn a small amount each day. However, that is being offset. Gamma is the enemy. If the underlying pair moves too far, then you get short deltas quickly (on a rally) or get too long (on a decline). Vega is the culprit you right now. Vega measures the dollars earned (or lost) every time the implied volatility moves higher or lower by one point. Right now it is moving higher. When the market falls and the put spread moves against you, the call spread will not decrease in value fast enough to compensate for the loss in the put spread.

FxWirePro: USD/CHF still non directional – Iron condor spread hedges as reducing IV in long run

Monday, September 28, 2015 11:17 AM UTC

Editor's Picks

- Market Data

Most Popular