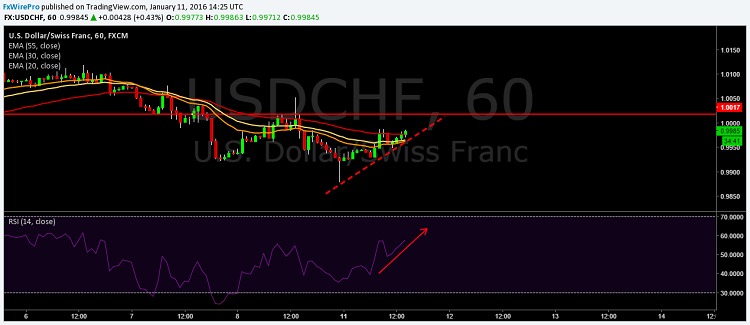

The USD/CHF rebounded from 0.9965 levels to hit high at 0.9983 levels, after Swiss retail sales printed negative figures in early European session. However after US session open the pair has continued to consolidate around 0.9987 levels.

- The short term picture depicts more bullish trend for this pair, as the pair is supported by rising trend line in 1 hour chart, the relative index is pointing upwards at 57, the 55, 30 and 20 MA's is indicating upward momentum . Overall the technical indicators are depicting upside for this pair.

- To the upside, the strong resistance can be seen at 1.0000, a break above this level would take the pair towards next resistance level at 1.0046.

- To the downside strong support can be seen 0.9970, a break below this level will take the pair to next level at 0.9955.

Recommendation: Go long around 0.9970, targets 1.0050, 1.0100, SL 0.9880

Support levels: 0.9955, 0.9950, 0.9930

Resistance levels: 1.0000, 1.0046, 1.0077