The USD/CHF pair traded around the 0.9969 levels for most of the European session, as the bunch of economic data released from Eurozone failed to bring any movement for the pair. However after ADP Employment data in the US session the pair hit high around 1.0006 before retreating towards 0.9986 levels.

- Currently the pair is trading around 0.9986 levels, it is set to advance further towards 0.9700 and 0.9680 levels in the short term.

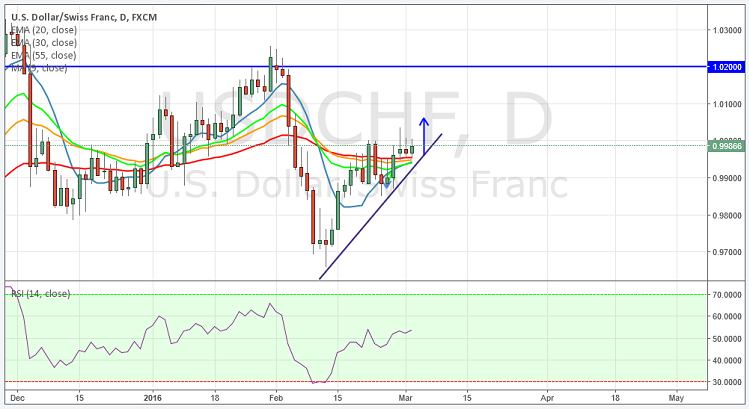

- Technically, the pair is supported by rising trend line in daily chart, the relative index is pointing upwards at 57, the 55, 30 and 20 MA's is indicating upward momentum. Overall the technical indicators are depicting upside for this pair.

- To the upside, the strong resistance can be seen at 1.0000, a break above this level would take the pair towards next resistance level at 1.0046.

- To the downside strong support can be seen 0.9970, a break below this level will take the pair to next level at 0.9920.

Recommendation: Go long around 0.9970, targets 1.0050, 1.0100, SL 0.9880

Support levels: 0.9955, 0.9915, 0.9880

Resistance levels: 1.0000, 1.0046, 1.0077