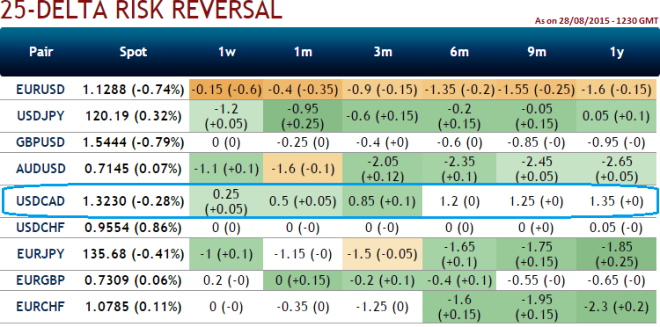

Since delta risk reversal of this pair divulges expensive hedging upside risks, as per the delta risk reversal computation in the money calls are overpriced premiums. In order to reduce the hedging costs, and those who expect the USDCAD to make a large move higher, then this strategy can be established as follows.

Purchase more number of out of the money +0.5 delta calls and sell in the money calls with a shorter expiry usually in a ratio of 2:1. The delta value remains high on the upside of underlying value as more and more upside price movements of the underlying makes the option position more sensitive to the relative change in USDCAD exchange rate.

So the lower strike short calls finances the purchase of the greater number of long calls and the position is entered for no cost or a net credit. The dollar has to make substantial move on the upside for the gains in long calls to overcome the losses in the short calls as the maximum loss is at the long strike.

FxWirePro: USD/CAD delta risk reversal signifies upside hedging – prefer CRBS

Friday, August 28, 2015 1:55 PM UTC

Editor's Picks

- Market Data

Most Popular