For the Bank of Canada (BoC) the intensifying trade war with the US is an increasing factor of uncertainty for its economic outlook – as it made clear at its meeting yesterday. With this exception, the image of the economy it painted was a positive one though. Inflation too is within the central bank’s target range, only weak wage growth remains a cause for concern. But everything all told the course is set towards further rate hikes.

However, the BoC is likely going to wait with its next rate step until it gets more clarity on the outcome of the NAFTA negotiations. Turning this around: the longer the uncertainty about NAFTA continues the more the market is likely to lower its rate expectations, which will weigh on CAD. No doubt that the truly critical phase is yet to come for the Canadian currency.

But a likely by-product of the loss of USD momentum is a pause or even a modest reversal in USD-correlations that have surged this year due to across-the-board dollar weakness. We do not expect any de-correlation to be very pronounced given the primacy of US monetary and fiscal policy in driving FX movements in 1H’18 before other G3 central bank actions assume greater importance later in the year.

Hence ‘hard’ de-coupling option constructs – for instance, dual digitals or worst-of options with out-of-the-money strikes –are not high %age trades in our view despite the attractive implied correlation levels they sell.

Carefully constructed vanilla option triangles can be a viable alternative to exotic options as a mild USD correlation breakdown construct. For instance, one could sell USD puts/JPY calls and USD calls/CAD puts (in equal USD notionals) but hedge out the resultant long CADJPY delta risk by simultaneously buying CAD puts/JPY calls of the appropriate strike (the equivalent cross-yen strike derived from the two USD leg strikes) and in appropriate notional amounts (equal to the yen notional of the USDJPY leg).

Because they involve selling two options and buying one, these triplets entail earning premium at-inception; and because ‘closing the delta loops’ of the triangle leaves little or no directional exposure to begin with, overt spot divergence is not a pre-requisite for retaining the upfront premium credit.

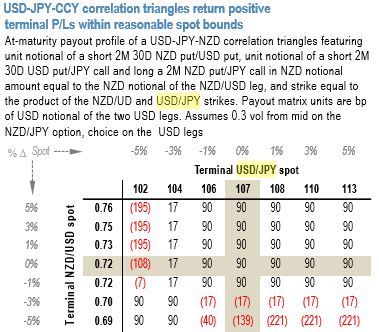

A scenario grid of spot levels at maturity helps visualize terminal payout outcomes; such an exercise for a USD-JPY-NZD triangle, for instance, shows that returns are positive in most states of world within (subjectively) sensible bounds of terminal spot, not only in the anti-correlated quadrants of the grid but also in significant portions of the rest of the table where traditional de-correlation structures fail (refer above nutshell).

Currency Strength Index: FxWirePro's hourly USD spot index has shown 43 (which is bullish), while hourly JPY spot index was at 25 (mildly bullish), NZD is flashing -85 (bearish) and CAD at -62 (bearish) while articulating at 09:49 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios