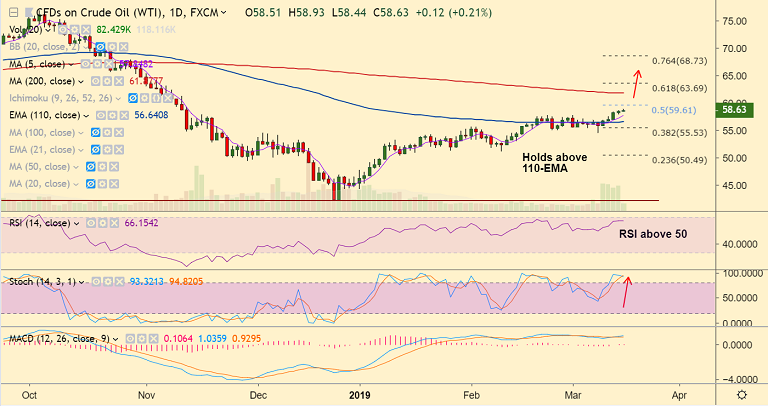

U.S. oil chart - Trading View

- U.S. oil extends break above 110-EMA, hits new 4-month tops shy of 59 handle.

- Potential deficit in the global supplies in the first quarter of 2019 supporting prices higher.

- Latest EIA report shows bigger-than-expected drop in the US EIA weekly crude stockpiles.

- Also, a decline in the US oil production propelled the black gold further to the north.

- Price action has bounced off 55-EMA with a 'hammer' formation. We see weakness only below 55-EMA.

- Technical indicators have turned slightly bullish. Decisive break above 110-EMA has raised scope for further gains.

- Next major resistance above 110-EMA lies at 50% Fib at 59.60. Retrace below 110-EMA and break below 55-EMA can see dip till daily cloud.

Support levels - 56.53 (110-EMA), 55.53 (38.2% Fib), 54.85 (55-EMA)

Resistance levels - 57.85 (Mar 1 high), 59.61 (50% Fib), 61.97 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-US-oil-bounces-of-55-EMA-with-Hammer-formation-stay-long-on-close-above-110-EMA-1508943) has hit TP1.

Recommendation: Hold for targets.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.