- US Oil trades trades 1.33% higher on the day, hits weekly highs at 67.26.

- WTI lifted by reports of US crude stockpiles draw and renewed USD weakness.

- Iran oil supply threats amid US sanction continue to offer buoyancy.

- Data by the American Petroleum Institute showed US crude stocks fell last week by 5.2 million barrels, more than three times the drop analysts expected.

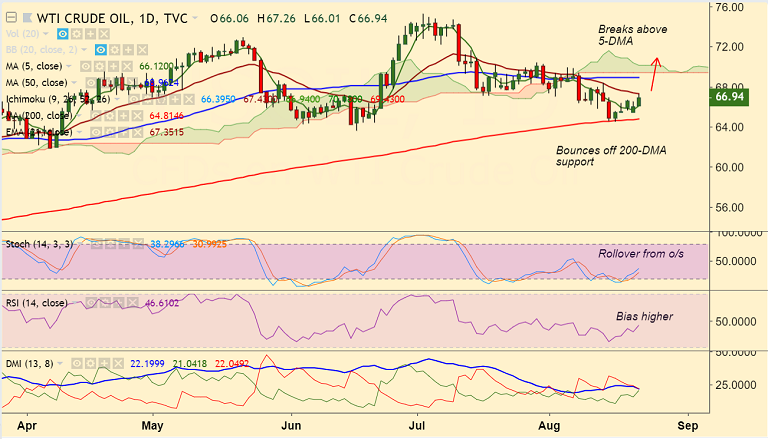

- Price action is extending gains above 5-DMA at 68.12. Breakout at 110-EMA to see further upside.

- Technical indicators are biased lower. Momentum indicators are biased lower.

- Break below 200-DMA will see further weakness. Scope then for test of 38.2% Fib at 62.57.

Support levels - 66.13 (5-DMA), 64.81 (200-DMA), 62.57 (38.2% Fib)

Resistance levels - 67.14 (110-EMA), 67.35 (21-EMA), 68.12 (55-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 27.0931 (Neutral) at 1245 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.