Allegedly the Canadian Minister of Foreign Affairs Chrystia Freeland seems to want to make concessions, in particular as far as the trade with dairy products is concerned (so far Canada is preventing the export of ultra-filtered milk from the US to Canada) as long as the US are willing to compromise in other areas, as in the question of dispute settlement mechanisms.

According to Prime Minister Justin Trudeau an agreement can be reached by tomorrow, if it was to be a “right deal”. The question is whether Trudeau will remain firm in some matters and might thus face the criticism that he sounded the death knell for NAFTA. Or whether following the successful conclusion of an agreement between Mexico and the US he is more conciliatory and moves away from his conviction of “no deal might be better than a bad one”.

We will know more by tomorrow evening. The publication of Q2 GDP this afternoon will get lost in all this, as the new trade agreement is much more important. If an agreement is reached by tomorrow evening CAD might record a relief rally towards 1.28 in USDCAD until tomorrow evening ahead of the weekend. Otherwise the cross is likely to move back up towards 1.30.

OTC Outlook and Options Strategies:

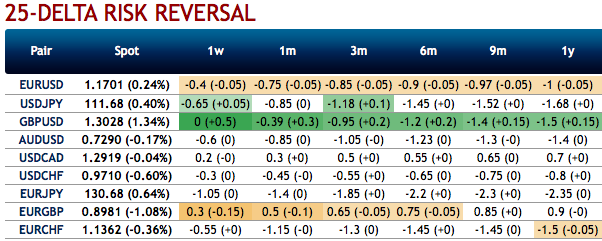

Before we move onto strategies, let’s just glance through the risk reversals of USDCAD across all tenors that are showing no changes, while IV skews of 1m expiries still signals bullish hedging bids. The positively skewed IVs imply that the bullish risks remain intact despite the above stated fundamental factors.

While 1m forward rates show negligible changes and bearish targets in the longer tenors.

Accordingly, we uphold staying short USDCAD through a low-cost RKO: The USDCAD put RKO was originally conceived as a low-cost option to gain exposure to what seemed like a decent chance of a near-term breakthrough in NAFTA negotiations.

Alternatively, buy 2m 1.31 USDCAD call, RKO 1.28, spot reference: 1.2924 levels. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 44 levels (which is bullish), while hourly USD spot index was at -63 (bearish) while articulating at (10:32 GMT). For more details on the index, please refer below weblink:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?