Consumer prices in the United Kingdom rose by 3.1 pct in the year to November 2017, following a 3 pct gain in the previous month and beating market expectations of 3 pct. It was the highest inflation rate since March 2012, mainly due to rising prices of transport, leisure activities, restaurants and hotels, housing and food.

The upside surprise would likely lead to the release of an open letter to the Chancellor alongside Thursday’s BoE interest rate decision.

As the impact of sterling’s depreciation on prices appears to have peaked, we expect a gradual easing in the pace of CPI inflation through next year. However, inflation is forecast to stay above the 2% target through both 2018 and 2019. Against that backdrop a key question for the Bank of England will be what is happening to domestic inflationary pressures and tomorrow’s labour market report will provide a further update on these. If not in short run, sterling seems to be sensitive particularly to idiosyncratic and to the whims and fancies of Brexit headlines in the medium run.

Although the end result of the past two weeks of drama around the EU-UK divorce bill has ended up with a reported breakthrough in the negotiations, we note this is but one of many hurdles in the overall Brexit negotiation process, which will increasingly dominate GBP in 2018 as we head closer to the cliff-date of March 2019.

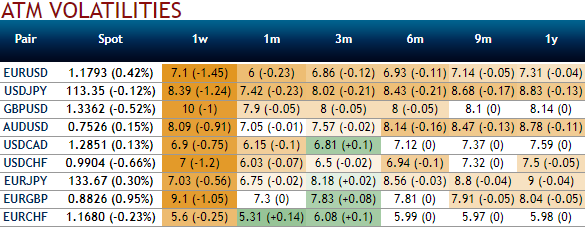

Depending on how the negotiation process evolves, with lackluster IVs in ATM contracts across all tenors and spiking IVs of 3m EURGBP ATM contracts (refer above IV nutshell), GBPUSD risk scenarios ranging from 1.26 to 1.47, and rather than a directional conviction in the spot, our favored GBP trade is to be long EURGBP vol.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation