The U.K.'s construction PMI dropped to a seasonally adjusted 55.0 last month from a reading of 57.8 in December to miss the forecasts at 57.6 in January. This leading indicator of economic health - businesses reacting quickly to U.K. market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

While GBP has been a mid-pack performer through November and early-December, without much independent direction. Although EUR/GBP has followed rate spread expectations closely, much of the variation in the spread has been driven by the EUR, rather than GBP, side.

Going forward, even though amid momentary pressure on GBP, we have a constructive view on GBP, largely driven by conventional monetary policy expectations and the under-pricing of the first, and subsequent, UK rate hikes.

Our economists continue to expect the first UK rate hike in May 2016. As markets move to re-price UK rate prospects, GBP should revert to outperformance on the crosses. EUR/GBP is expected to break back below 0.70 in the early part of 2016 and GBP outperforms all other G10 currencies with the exception of USD on that time horizon.

Further into 2016, there are two key risks for GBP - the UK's unsustainable current account deficit and the EU referendum, promised for end-2017 at the latest. We think both are manageable, however, and the current account may actually strengthen the case for GBP outperformance.

As such, we discuss some key considerations that relate to economic developments herein, assessing risks ahead of the central bank's policy stance in the months to come, EU referendum, GBP's gains against euro, now if you think speculation in potential uptrend in short terms, overpriced puts come into picture.

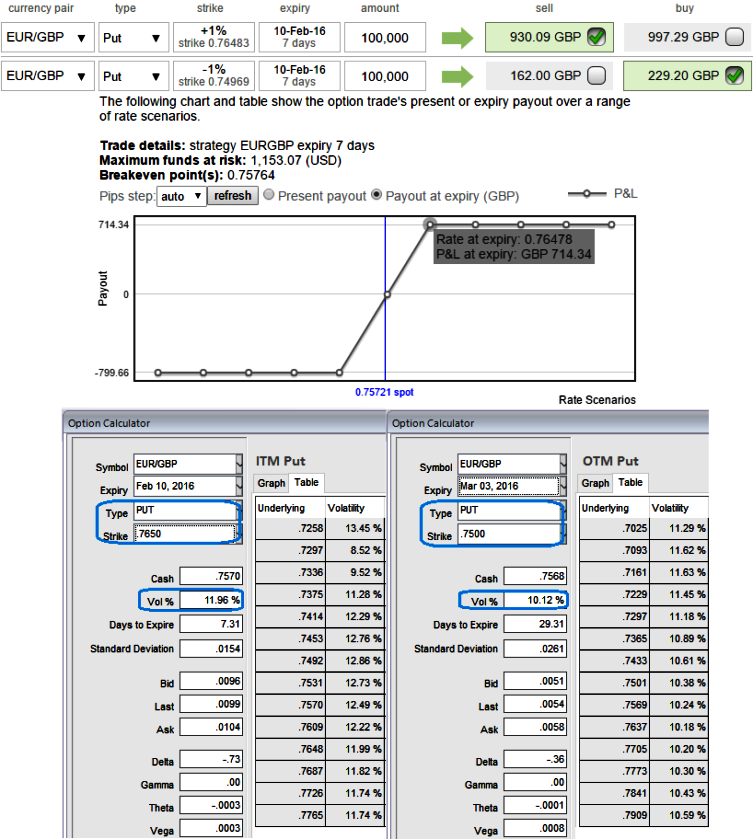

If you expect that EURGBP would either remain sideways or spike up moderately over the next near future, which is currently at 0.7572 spot FX then you should probably decide to initiate a bull put spread at net credits, buy 1M (+1%) out of the money -0.21 delta put option. Simultaneously, short 1W (-1%) in the money put with positive theta.

Notice in this instance that the put we bought is out of the money and the put we sold is in the money with an anticipation of EURGBP could rise or remain unchanged, and there onwards any abrupt fall would be taken care by longs in OTM put and your active longs in spot FX would be protected.

Please be noted that the expiries used in diagram are meant for demonstration purpose, prefer expiries as stated above.

Maximum profit: The initial credit received for this trade, less commission costs. The maximum risk is the difference between the two strike prices, minus the credit you received.

FxWirePro: UK construction PMI leads GBP’s momentary weakness – gain via EUR/GBP credit put spreads in interim upswings

Wednesday, February 3, 2016 7:45 AM UTC

Editor's Picks

- Market Data

Most Popular