Before we begin, let’s recall as to how the Bank of England confused the markets in previous MPS. There was a widespread surprise when the MPC chose to leave rates unchanged at the 14 July meeting. But we needed wait no longer. The minutes of the July meeting made it crystal clear that the MPC will ease in August.

For now, there is no reason in pretending otherwise: the Brexit vote would be a hard blow for the UK economy in the months to come. Although the economy developed in Q2, the collapse in Q3 and forward guidance are very painful.

The PMI has provided a first taster. It eased significantly from 52.4 points in June to 49.1 points in July, the final estimate now resulted in a real collapse to 48.2 points. The PMI for the service sector, where the final result will be announced tomorrow, had collapsed from 52.3 to 47.7 in July and points in the same direction.

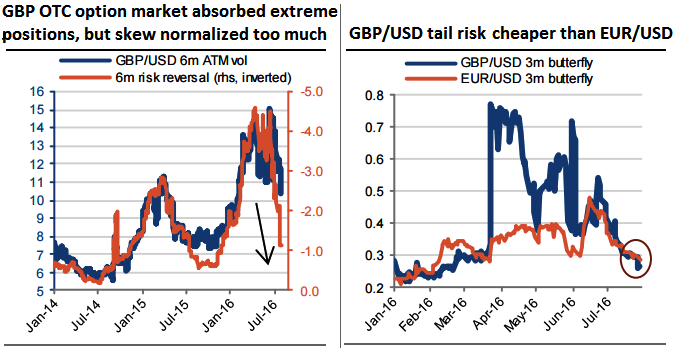

Cable skew normalised too much Five weeks after the Brexit vote, the GBP volatility market normalised sharply. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

The cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBP/USD butterfly is now less expensive than the EUR/USD butterfly, which is unsustainable given the GBP extra tail risk.

Volatility investors in GBP should consider buying OTM puts and/or being long of the smile convexity, against ATM volatility. But further cable weakness to come suggests building a directional and volatility position at the same time: the value of OTM puts will rise if the pair breaks below 1.30. We therefore recommend buying a 3m risk reversal.

We expect BOE to cut rates to keep it at 0.25% (the new floor) and QE to be restarted at a pace of £25bn per quarter. The GBP/USD tracked the probability of an August cut since the start of the year, including during the Brexit turmoil. The actual announcement of the monetary policy decision could be the trigger of the next leg of GBP weakness.

Hence, the sufficient reason for the Bank of England (BoE) to ease its monetary policy notably on Thursday to counteract the expected economic slump. As a result, times remain difficult for Sterling and it is unlikely to have much scope for a recovery at present. In GBPUSD 1.35 caps, in EURGBP 0.8200-0.8250 remains a strong area of support.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist