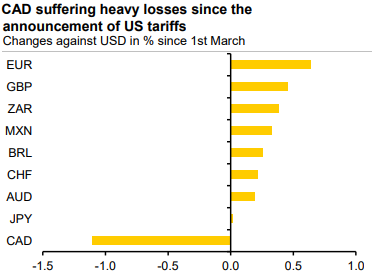

The Canadian dollar is most affected by the step up in (trade) war rhetoric. The loonie once again recorded losses yesterday after President Donald Trump made it clear that the NAFTA partners Mexico and Canada would not be exempt from the tariffs on steel and aluminum imports unless they compromised with the US in the NAFTA negotiations.

According to the US trade representative Robert Lighthizer, who spoke to the press at the end of the 7th round of negotiations in Mexico City, this was an “incentive” to bring the negotiations to a rapid conclusion - ideally ahead of the Mexican Presidential elections in July.

Even though it is unclear how the negotiations will proceed now, whether there will be a pause until after the Mexican elections or whether they will continue in April, MXN was able to retrace its previous losses following the press conference while CAD continues to trade weaker against USD - which is also likely to be due to the fact that steel and aluminium exports are economically much less relevant for Mexico than they are for Canada.

Now CAD has to pay for the fact that until January the risk of trade frictions with the US hardly played a role for CAD - contrary to the situation of the MXN - so that these risks clearly had not yet been priced-in adequately. Only when the Bank of Canada (BoC) commented in more detail on the uncertainty arising from increasing US protectionism in January did the risk of a trade war become an issue for CAD traders too. That means tomorrow’s BoC rate meeting will be decisive for the immediate CAD outlook: if despite the recent developments, the BoC keeps the door open for further rate hikes during the course of the year, CAD is likely to be able to resist further notable depreciation.

Trade recommendations:

Bought a 6-mo 0.9450-0.9120 AUD put/CAD call for 74bp on November 21st. Unwound at 10bp.

Risk-averse traders who are uncertain about trend directions, go long in USDCAD 1M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 1w (1%) out of the money puts. Thereby, we slightly favor bulls as we foresee more upside risks by keeping longer tenors on call leg. But by having written overpriced OTM put likely to reduce cost of hedging.

Mexican uncertainty if AMLO wins is well hedged by buying post-election MXN forward volatility. In terms of outright trades, we hold short MXNJPY positions, bearish MXN trades through debit put spreads.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis