The broad USD complex may attempt to look for new directional cues early this week, before reverting back to trade issues towards the end of the week. High beta no-touches seem like an inert play on a snail’s pace of Fed. Along with EUR/EM constructs that take advantage of high carry-to-vol, with the Fed in a slower gear than the markets expected here we widen the net by employing no-touch structures as a passive play on limited upside in high beta FX. No-touches can be seen as defined downside alternatives to selling naked vanilla high beta & EM puts and are well suited to take advantage of the modestly risk-positive environment that should emerge after the trade dust settles.

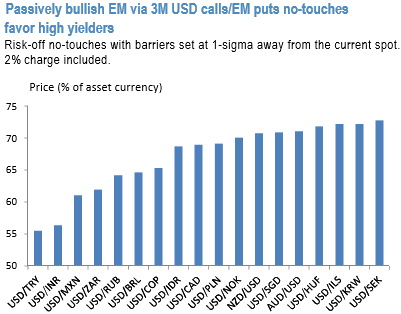

The 1st chart ranks 3M high beta structures with barriers set to 1-sigma away from the spot (arbitrary condition but sets pricing of different pairs on similar footing and strikes us as a sensible barrier selection).

No-touches take advantage of elevated fwd points, vols, and skew. Effectively vol selling structures, no-touches are inherently low leverage trades, as is the case for other income harvesting strategies (e.g.vol, carry and vanilla selling).

The 2nd chart demonstrates the back-test of buying of no-touches relative to selling vanilla USD calls/EM puts for a basket of 10 USD/EM pairs and outlines the capped downside advantage of NTs during the dollar rallies that makes NT performance risk-reward characteristics favorable.

Given our analysts’ constructive view on USDBRL and USDRUB and favorable pricing consider:

Buy 3M USDBRL call no-touch with barrier @3.400, the level not breached since Dec 2016, costs 39.5 %USD.

Buy 3M USDRUB call no-touch with barrier @59.00, the level not breached since last Dec, costs 45 %USD. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand