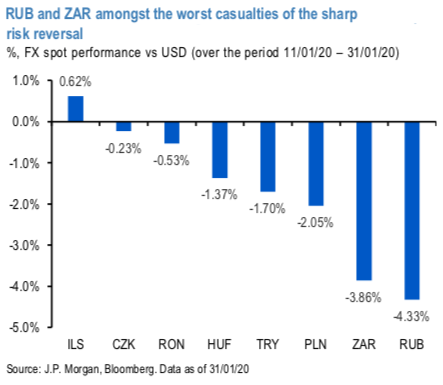

Mounting apprehensions and anxiety revolving around the coronavirus that has seen markets come under pressure. Since the first fatality related to the coronavirus was announced in January, the risk aversion has come to the fore in EMEA EM FX, with both RUB and ZAR amongst the worst casualties of the sharp risk reversal (refer 1st chart). The market continued to trade poorly as global sentiment also deteriorated.

ZAR and RUB have been the two currencies in the BRICS-bloc that are down for another session with both depreciating considerably (around 1.5%) against the dollar. RUB depreciation may have been exacerbated by the 3% fall in Brent to $58/bbl. The ruble approached 63.50, which was previously a strong support, and as such we may see some interest in reloading EM risk.

For ZAR, fiscal challenges and downgrade risks are likely to once again come to the fore. Despite both positioning and valuations appearing favorable (refer 2nd chart), ZAR is likely to be remain vulnerable to domestic issues.

Quite a few economists project a technical recession with a 0.3% QoQ GDP decline in 4Q19, resulting in full year growth of 0.3% only in 2019. Poor growth performance will result in slippage in the already dismal MTBPS fiscal projections - 2019/2020 deficit is likely to end up at 6.2% GDP (vs. 5.9% GDP projected).

We expect the rand to be fragile heading into the key budget event on February 26th, and as such hold an UW ZAR in the GBI-EM model portfolio and a 14.75/15.30 1x1 USDZAR call spread.

While we continue to consider 3M delta-hedged USDRUB 1*2 ratio call spread (ATM/25D) in vega notionals @9.65ch against @10.9/11.3 indicative.

Alternatively consider a RUB – ZAR RV trade, supported by the earlier screener on skews: Sell 3M delta-hedged USDRUB 25D call @10.9/11.3 and hedge it with 3M delta-hedged USDZAR 25D call @16.325/16.725, equal vega. Courtesy: JPM & Morgan Stanley

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation