Yesterday’s CBT’s MPC meeting could have gone in one of two ways: we held an original base view that CBT would cut the benchmark rate by 100bp; but we later revised this to 50bp because the lira was weakening exponentially in recent days and we reckoned that CBT might want to be cautious.

Nevertheless, we also thought that 50bp versus 100bp would not make much difference to the lira’s trend. So, it was still possible that CBT would come to the same conclusion and cut the rate by 100bp regardless. This is what happened. USDTRY is well on its way to surpass 7.00 in coming days and this might anyway have happened irrespective of the size of rate cut.

In a side development, the media reported that CBT will raise the ceiling on the size of lira swap transactions to 30% of total limit on foreign exchange and derivative transactions, up from 20%. This increase comes on the back of the bank regulator’s imposition of an asset ratio on banks, which encourages swaps with CBT in addition to lending and holding government bonds; the higher limit by CBT could increase FX reserves by c.$5bn. This policy change is unlikely to noticeably affect the lira exchange rate.

Hedging Strategy:

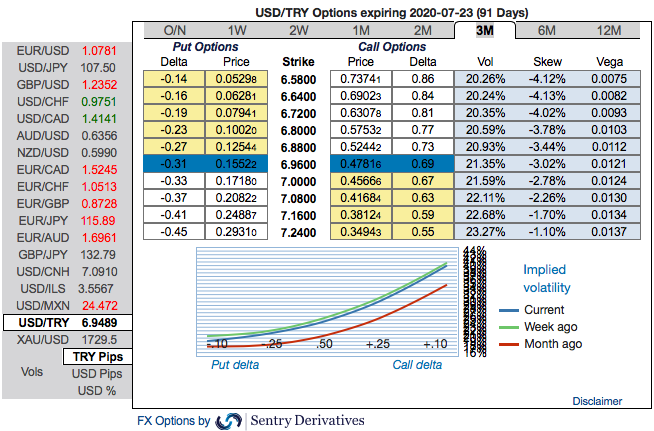

On hedging grounds, capitalizing on prevailing price dips and above driving forces, we already advocated 2m USDTRY debit call spreads with a view to arresting momentary downside risks and upside risks in the major trend. At spot reference: 6.56 level, we initiated 2m 6.25/6.96 call spreads at net debit, it’s been functioning as desired so far. The prevailing spot FX is edging above 6.95 levels, hence, we wish to uphold the same strategy as short leg is still out of the money and one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The skewness of 3m IVs are not stretched on either side, but slightly biased for the upside risks, higher bids for OTM calls are hedging bias towards upside risks (refer above nutshell).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry & Commerzbank

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms