Positive factors less likely to drive CAD than draggers:

Trump’s protectionist declarations, notably labelling NAFTA as the “worst trade deal in the history of the country”, make the Canadian dollar especially vulnerable in the weeks ahead. Clinton has been ahead in the polls most of the time, but Trump is again catching up.

Clinton’s lead is less than two points, suggesting that the election outcome is likely to be very uncertain until the vote. The threat weighing on Canada’s status as a privileged trade partner should be increasingly discounted by FX markets.

In addition to that BoC’s dovish shift biases near-term CAD weaker: The BoC September policy meeting was dovish, as the bank significantly shifted the risk profile to inflation from “roughly balanced” to now “tilted somewhat to the downside”.

The commodity-related Canadian dollar was also hit by tumbling crude price on Friday due to reports that Iran's August crude oil exports jumped 15% to a five-year high of more than 2 million barrels per day, sparking fresh concerns over a global supply glut. Supply adjustment or an OPEC deal causes crude to pierce $60/bbl earlier than expected.

USDCAD has been trading sideways in a range for months but is currently testing an important resistance area. A decisive break of the 1.32 region would open the door for fast gains.

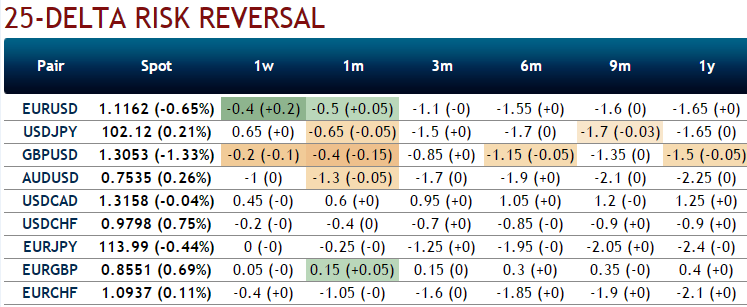

From the nutshell showing delta risk reversals of USDCAD, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence