Prices of the yellow metal are up nearly 15% so far this year as investors seek safe havens in the face of mounting instability in other financial markets

Technically, as we were discussing in our recent write up on this commodity, although the intraday bears are active it is advisable to carry short trades for deliveries as the intermediate trend seems uptrend and it looks like making a reversal of major downtrend.

It is evident that the bulls have managed to clear the major hurdle at 1225, 1294.50, and now at 1341.26 levels (i.e. 38.2% Fibonacci retracements from the bottoms of 1046.23 levels (see monthly graph).

OTC Outlook:

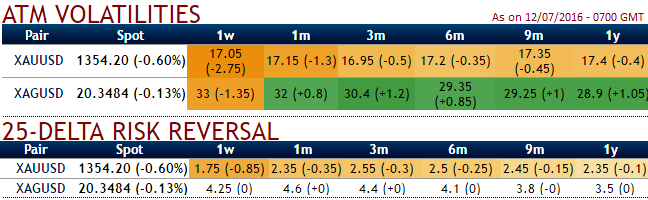

ATM IVs of gold contracts across all tenors have reduced remarkably, it is considered as the good news for option writers.

While delta risk reversals are also flashing up with negative changes in bullish hedging arrangement especially the highest negative tickers during 1W expiries, we hope you may probably correlate this with the above-mentioned intraday downswings. With this OTC indication what we could empathize is that bulls have halted momentarily but intermediate uptrend still seems intact. As a result, we like to deploy below option strategy to deal with the baffling swings in spot gold prices.

Option strategy for Gold's puzzling:

The Execution: Contemplating both fundamental and technical reasoning in mind, it is advisable to go long in 2M (1%) OTM 0.36 delta call while writing 2W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the gold spot price is anticipated to drop moderately in the near term and spikes up in long term.

Trade expects that the underlying gold spot price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the gold's struggle in the short run by shorting, and hedge any dramatic upside risks in the long term via longs in OTM strikes which is why we've used diagonal expiries.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

BEP: The break-even point lies between ITM and OTM strikes.

Risk: If the underlying spot gold price rises above the strike price of the higher strike call at the expiration date, then this bear call spread strategy likely to suffer a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data