Great Britain and the EU would continue to negotiate about a Brexit agreement constantly in the future. That was the result of yesterday’s meeting between the UK Brexit Minister Dominic Raab and the EU chief negotiator Michel Barnier.

While Raab also seemed optimistic that the negotiations can be completed in time for the EU summit in October (18th/19thOctober), Barnier did not want to commit to that. One thing is clear: the agreement will have to be reached well before year-end to leave sufficient time for the ratification ahead of the actual Brexit by the end of March 2019.

However, the longer the negotiations drag on for the more the FX market has to fear a no-deal accident, i.e. that the UK will leave the EU without a transition agreement which would entail notably elevated risks premiums for the GBP exchange rates.

During the course of the week the British government wants to publish various analyses on the possible consequences of a no deal Brexit – Raab yesterday announced further details on this for Thursday. These are not only going to be relevant for the further progress of the negotiations but also for the GBP exchange rates.

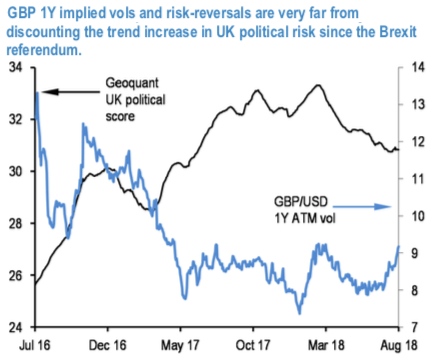

One could argue that GBP vols and risk-reversals have not kept pace with the trend increase in political risks in the UK since the Brexit referendum.

The above chart exhibits a new-age index of political risks scored by Geoquant based on a mix of structural country risk metrics and higher frequency formal and social media data (GEOQUKPR Index(Go)); its lack of directional correlation with option price based measures of sterling risk suggests that an unpleasant surprise could be in store for GBP options should markets focus more squarely on the no deal scenario.

Considering 1.20 on GBPUSD to be the hard Brexit threshold – not unreasonable since 1.20 is the spot low in the aftermath of the Leave vote in 2016 – pricing on 1Y 1.20 strike GBP put/USD call digital options of 15.7% of USD notional (mid) at current market (1.2778 spot ref.) strikes us as being on the low side, on net indicating that option markets assign more than 50% additional probability to a benign resolution to UK/EU.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -57 levels (which is bearish), while articulating (at 14:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand