Collect theta on AUDUSD and USDCAD vol ratio spreads traded via Gamma timing filter:

Risk premium harvesting via traditional straddle selling can be a challenging proposition when spot gyrations pose risk in front-end tenors and inverted curves challenge executing it in the back tenors. A close but a safer alternative is 1*N ratio call or put spreads (delta-hedged) on the rich side of the skew as a class of structures that can monetize risk premia in vol smiles. Placing the short notional overweight on the “risk-off” side, these structures sell risk-reversals resulting in quick collection of premium but are exposed to left tail and thus suitable only when there is no imminent risk from sell-offs.

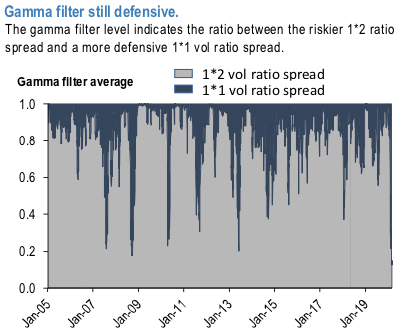

To solve the left tail issue we follow on the heels of our prior work on gamma trading filter (Total-return version of tactical filter allowing long Gamma trades) and utilize the filter in vol ratio spreads trading. The model relies on a set of common global indicators and along it currency specific variables that assess level of risk-aversion in the broad markets. We use the gamma timing filter to determine the notionals split between 1*2 vega ratio spreads and M/N (market neutral) ratio spread. The G10 average filter signal as given in the 1st chart is always within (0,1) range. The value of e.g. 0.75 means that 75% of the notional goes toward 1*2 and 25% into M/N risk ratio structure.

The historical average has been around 87-88% across currencies. The switching methodology is admittedly crude and could be optimized for different splitting formula, introduce thresholds, and/or optimize choice of structures. The long-term backtest in 2nd chart shows a clear benefit from utilizing the filtering methodology, with the volatility of returns materially improved as the max drawdown is cut by almost 50%.

One intuitive way for screening for the currencies with the most favorable backdrop for 1*2 vol spreads is to look at the following: a) medium-term performance, e.g. 3-year Sharpe, and b) current pricing of the 1*2 structures expressed as 1-y zscore of skew / ATM vol ratio.

Among the USD pairs at the current markets, the high beta G10 AUD, NZD and CAD screen the most attractively (the upper right quadrant in 3rd chart) thanks to the elevated skew vols, but the gamma filtering strongly suggests to express the structures via 1*1 vol ratio spreads rather than the more aggressive 1*2s. Courtesy: JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios