Year-2018 for cryptocurrency has had the mixed bag of sentiments amid series of regulatory and fundamental news.

Cryptocurrency derivatives have been the centre of attraction in the recent past. Cryptocurrency derivatives, including cryptocurrency futures, cryptocurrency CFDs, and cryptocurrency options) have been under the meticulous scanner of the renowned global regulators, such as, US SEC, CFTC and UK’s Financial Conduct Authority (FCA).

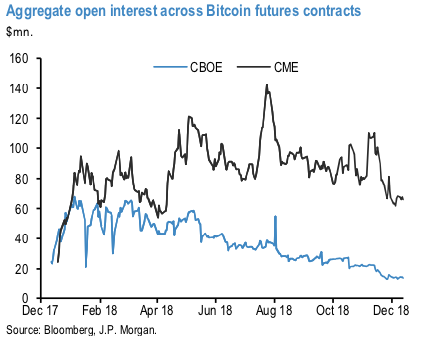

Participation by financial institutions, proxied by Bitcoin futures volumes in CBOE and CME, has declined also.

As 1stchartshows, open interest in the CME contract, where futures activity has increasingly concentrated, has declined to $65mn this week, at the very low end of this year’s range (refer 1stchart).

The open interest in the CBOE contract continued its downtrend to the lowest level since inception.

More importantly futures volumes as a proportion of trading volumes on bitcoin exchanges has declined to below 1%, the lowest level since the beginning of the year and well below the 10% high seen in the summer (refer 2ndchart).

In other words, participation by financial institutions in bitcoin trading appears to be fading. Courtesy: JPM

Trade tips: At spot reference: 3704 levels, on trading grounds, one can initiate BTCUSD boundary option spread strategy with upper strikes at 3900 and lower strikes at 3515 levels.

The trading between these strikes likely to derive certain yields in this perplexed trend in the short term, more importantly, these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 3900 > Fwd price > 3515 levels).

Alternatively, one could initiate long positions in CME BTC futures contracts of near month tenors with a view of arresting upside risks.

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 12:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise