EM & G10 vol trading: After a rather tumultuous week, markets have begun this week on a calmer footing. In the UK, Brexit remains the focus and whether the PM will face a ‘no confidence’ vote, or not. Meanwhile, recent rhetoric from Fed officials, suggesting the US is close to neutral, has seen bond markets lose further confidence in the Fed’s forward guidance of four more hikes. US yields finished the week under significant pressure, which weighed on the USD.

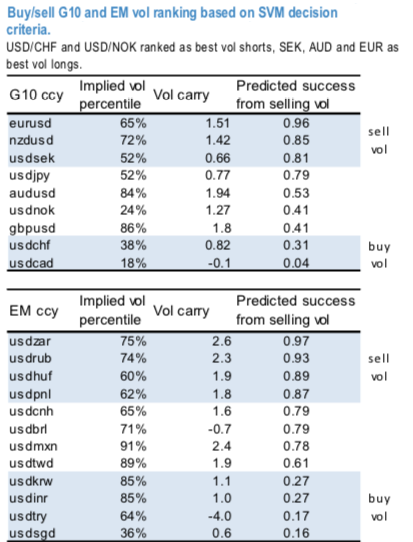

A framework based on machine learning techniques has been utilized in long/short G10 and EM FX vol trade discovery process. The resulting trading models give likelihood of making profit from selling / buying gamma vols based on modelling of a non-linear decision boundary for vol trading decision making for implied volatility pricing and vol carry (two cornerstones of gamma trading).

The above nutshell lists G10 and EM dollar pairs and their consequent predicted success from selling vol.

FX Options market is pricing in very modest level of day weight (comparable to historical pricings of more eventful central bank meetings) for the US mid-term election on Nov 6. Realized vol in CAD- and CAD crosses have crept higher in recent weeks in response to oil prices swings and this firmness can sustain in lead up to the Iranian sanctions coming online in Nov.

Within that setup CAD vs NZD expression can be considered as a straight gamma spread without having to resort to pre- vs. post-calendar spreads for isolating event risks. This RV is also reinforced in our SVM based gamma vol trading, which expects CAD gamma to perform vs NZD gamma vol to be soft in near term. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD is inching at -29 (which is bearish), NZD spot index is flashing at -51 levels (which is bearish), while articulating (at 12:04 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate