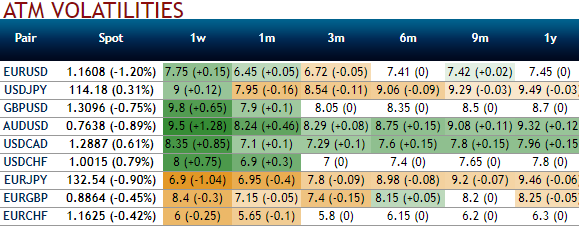

Please be noted that even after monetary policy season, FX vols have collapsed to the lowest level (especially euro and Swiss franc), let’s have a glance through the implied volatilities of EURCHF and USDCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment. These lower volatile conditions are conducive for the option writers.

Please also be noted that the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks in the long run as it indicates puts have been relatively costlier. The sell-off in USDCHF was too little, too late for our put spread that expired OTM.

USDCHF 3M3M FVAs have lagged the upturn and are value buys along a mildly inverted curve. Holding USDCHF vol appeals because it can benefit from the full gamut of risk triggers that can afflict all USD-vols, is a useful hedge overlay on a bullish Euro macro portfolio, and retains exposure to idiosyncratic CHF weakness of the kind seen recently, all without the threat of overt SNB management that can frustrate outsized sell-offs in EURCHF.

The FVA format is motivated in part by the fact that USDCHF forward vols have severely lagged the surge in CHF-complex gamma, and partly by the mild inversion of the vol curve that ensures optically appealing flat slide/rollover time.

The options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Admittedly some of the term structure shape is due to the forward starting 3M window covering the quiet holiday weeks of late December (3M3M = mid-November’17 to mid-February'18) that depresses 6M vol, but despite that, it may not be the worst idea to take delivery of and own USDCHF straddles through the first half of December that can reprise the above-average volatility of previous years around ECB and Fed meetings when tapering and rate hike decisions are expected to be announced.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data