Risk sentiment is also what is causing trouble for the Swiss National Bank (SNB). The quest for currency safe havens is causing the Swiss franc to appreciate. Most recently, EURCHF traded back below 1.13 and thus in areas that make FX market interventions on the part of the SNB increasingly likely, even if it is only because it wants to signal its presence to the market. In view of historic developments, we consider the area of 1.1250 to constitute a risk area, but at 1.10 at the latest the SNB’s patience is likely to have been exhausted.

We maintain a decent exposure to CHF this week but rotate a slightly underwater position in USDCHF into an outright short in EURCHF due to ongoing noise in Turkey and what could be a greater focus by investors on the Italian budget into September.

GBPCHF has performed very well as investors for whatever reason have belatedly woken up to the non-negligible risk of a no-deal Brexit, and the sensitivity of GBP to this would suggest that investors have some reasonable GBP exposures that are under hedged.

As for CHF itself, we continue to highlight the ever- present positive balance of payments disequilibrium that can only be exacerbated by heightened EM stress, namely a current account that is too large for private sector investors to recycle given still relatively low average rate differentials between CHF and ROW.

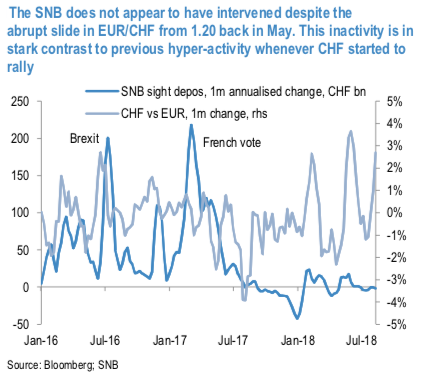

The SNB has pretty much single-handedly recycled this surplus for an entire decade since the GFC hit, but with a balance sheet that has mushroomed to 125% of GDP as a result of this systematic FX intervention, legitimate questions marks exist over the SNB’s capacity and willingness to continue to take the other side of commercial flows, let alone absorb another round of deleveraging of whatever cross- border CHF funding positions may exist. It is quite notable that the SNB appears not to have intervened since EURCHF rejected 1.20 back in early May (refer above chart).

Stay short positions in USDCHF at spot reference: 0.9665.

Sell EURCHF at 1.1350, stop at 1.1550.

Stay short GBPCHF from 1.3051. Marked at 2.29%. Lower stop to 1.30.

Currency Strength Index: FxWirePro's hourly CHF spot index is inching towards 161 levels (which is bullish), while hourly USD spot index was at 6 (neutral) while EUR at -72 (bearish) and GBP at 42 (bullish), while articulating (at 11:10 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary