It seems like Christmas has come little early for the UK economic policy watchers. With the Budget today and a Bank of England interest rate update on Thursday we are spoilt for choice for things to talk about. This week we take a look a look at the policy outlook and the implications for the economy. The MPC is not anticipated to publish any inflation forecast at the two-year horizon that is much different from the 0.1ppt overshoot of the 2% CPI target presented in August.

Cable prices are attempting to dig in around the 1.2795 region. A rally through the 1.2865-1.2945 intra-day resistance is needed to suggest a more significant low has actually developed, which would be part of a broader medium-term range between the 1.2660 lows and 1.3315 Autumn highs. However, while under those levels, downside risks remain, with a break of the 1.2660 lows seeing next support in the 1.2595 region and then around 1.2500.

The G10 currencies are mixed vs the USD. NZD and SEK are notable outperformers. GBP and CAD are up modestly while EUR is unchanged.

The run-up to the crucial EU summit this week was marred by an unexpected impasse in Brexit talks as the government abruptly signalled that it could not support the draft withdrawal text that its officials and those of the EU had been working on. The macro view is that the pound’s relatively sanguine reaction so far to this latest snag in Brexit talks probably reflects the assumption that this is little more than brinksmanship and runs the risk of being proven too complacent.

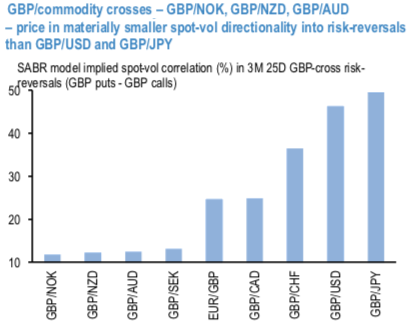

In contrast to GBPUSD options that bore the brunt of Brexit risk premium injection as a result of these developments – 1M 25D risk-reversals widened back out to near YTD extremes at 1.4 vols for GBP puts and have remained there even as 1M ATMs have retraced their week- to-date jump almost entirely – we find that risk-reversals in GBP/commodity crosses are relatively much more benignly priced. The 1st chart that ranks GBP/G10 in order of the spot-vol correlation embedded into 3M 25D risk- reversals: in contrast to GBPUSD and GBPJPY skews that price in 40% - 50% spot-vol corr., riskies in the likes of GBPNOK, GBPAUD, GBPNZD and even GBPCAD discount much less GBP stress in sell-offs. Subdued GBP put premia in these crosses is also out of kilter with recent realized spot-vol correlation: The 2nd chart exhibits that delivered directionality over the past month is outpacing option implied levels to the tune of 20-40% pts. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 49 levels (which is bullish), while hourly GBP spot index was at -105 (bearish) while articulating (at 12:50 GMT). For more details on the index, please refer below weblink:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons