UK currency dropped to the day’s lows against the dollar today as the UK consumer price inflation eased to 3 percent in December 2017 from a near six-year high of 3.1 percent in the previous month, as widely expected. Prices rose at a softer pace for transport, recreation and culture, housing and utilities, and food and non-alcoholic beverages.

While Brexit continues to dominate GBP, which is not unreasonable as there is a risk premium of between 10% (cyclical) and 15% (structural) for the long-term consequences of Brexit. This risk premium would be excessive if the UK were to secure a good outturn (a new trade deal tantamount to a permanent stand-still arrangement), yet inadequate in the event of a non-negotiated Brexit.

This process therefore still has the potential to drive large and potentially abrupt movements in GBP, albeit this shouldn’t completely overshadow more prosaic fundamentals. And on this front, conditions have moderately deteriorated for GBP as the UK economy is being left behind as the ROW powers ahead.

This is most notably the case for EURGBP as the Euro area economy is set to out-grow the UK for three consecutive years. The impact on GBP of this chronic, economic underperformance has been masked by the tightening in BoE policy (we expect two more hikes this year, the market one), but we continue to regard this rate cycle as being inherently bad news insofar as it reflects high inflation yet low growth. We do not believe it will sponsor the 6-7% appreciation in GBP typically associated with a hiking cycle.

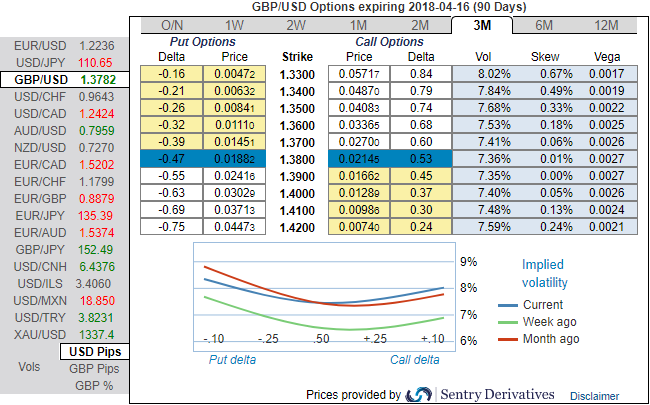

OTC indications (GBPUSD):

Let’s glance at sensitivity tool, the positive shift in risks reversals in shorter tenors indicates the momentary bullish risks in underlying spot FX prices, while long-term bearish hedging sentiments remain intact. This is justifiable as we've had the considerable bearish major trend since July 2014 prior to the prevailing consolidation phase.

Positively skewed IVs of 3m tenors have been well balanced that signifies the hedging interests on both OTM put/call strikes that means the ATM instruments have the higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in comparatively shorter tenors are favorable to both call and put options holders’ advantages.

Whereas the 6m skews have still been indicating bearish risks, this stance is substantiated by the bearish neutral risk reversals that indicate hedgers still bid for downside risks. ATM IVs are still stuck between 7-8% ranges for 3-6m tenors.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned to 51 (which is bullish) on UK’s CPI data prints which is line with consensus (actual 3.0% versus consensus and previous prints at 3.0%), while hourly USD spot index was creeping up at shy above -74 (bearish) while articulating (at 10:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis