Retail sales volumes MoM in UK surged by 1.9% in October, exceeding all expectations (CON 0.5%; LBCB 0.6%) after a modest 0.1% gain in September. Some strength in today’s report was expected, with advance indicators of retail activity – including the British Retail Consortium’s survey and weekly sales returns from John Lewis.

Looking ahead, headwinds to retail spending activity are likely to become more apparent over the course of 2017. The annual pace of retail price deflation slowed further in October, to 0.7% from 1.1% in September, and the outlook over the coming months is set to reflect sterling’s substantial post-referendum depreciation. A push higher in inflation will sap households’ purchasing power, which seems likely to weigh both on retail spending volumes, and consumer spending more broadly.

While unemployment claims in the UK is also improved from previous 4.9% to the current 4.8%.

OTC updates and Option strategy:

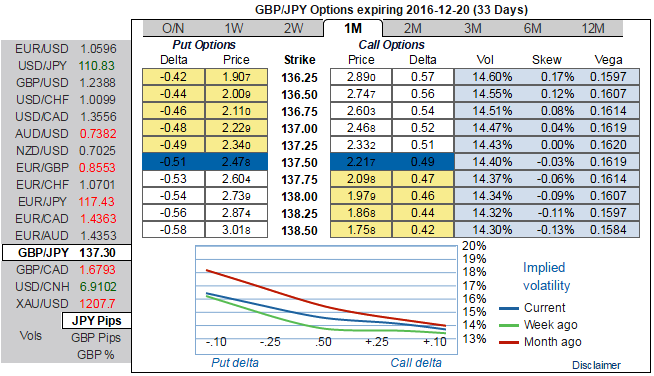

Ahead of quarterly GDP flashes in the UK that is scheduled for next week, 1m ATM IVs of GBPJPY are trading higher above 14% and positively skewed IVs suggest the OTC hedging interests in OTM put strikes, which means considering the current rallies and long term bearish trend we advocate below option strategy on hedging grounds.

Go long in 2 lots of 1m ATM -0.49 delta puts, while long in +0.51 delta put of the same expiry, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is Limited to the price paid to buy the options.

The reward is Unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong – but the stock has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch